What Is the Best Financial Planning Process?

In today's rapidly changing world, financial planning is not just a luxury but a necessity, which holds especially true in Singapore. The city-state, known for its economic prowess and financial strength, requires a well-crafted financial plan to navigate its high-cost living and unique economic landscape.

In this article, we'll explore the intricacies of mastering financial planning in Singapore with the guidance of MoneyFitt, a leading financial planning tool. We'll delve into Singapore's financial landscape, MoneyFitt's approach, the key components of the financial planning process, and how you can leverage their services to secure your financial future.

Mastering Financial Planning in Singapore with MoneyFitt

Understanding Financial Planning and Relevance of Financial Planning in Singapore

Financial planning in Singapore is the art of strategically managing your finances to achieve specific life goals, whether buying a home, funding your children's education, or preparing for retirement. It's about more than just saving money; it's about making your money work for you. In Singapore, this practice is incredibly relevant due to the city's high cost of living, evolving economic landscape, and the imperative of long-term financial stability.

Introduction to MoneyFitt's Role

MoneyFitt is a trusted financial planning tool that helps deliver tailored guidance for Singaporeans. The platform offers access to expertise and a commitment to assist you in overcoming Singapore's unique financial challenges and achieving your financial goals. Let's delve deeper into how they can help you master financial planning in Singapore.

Understanding Singapore's Financial Landscape

Economic Overview

Singapore boasts a robust economy with thriving trade, financial services, and a well-developed infrastructure. While this economic stability presents ample opportunities, it's also accompanied by an elevated cost of living and distinctive financial challenges.

Unique Financial Challenges in Singapore

The cost of living in Singapore is among the highest globally, presenting financial hurdles. Housing, transport, healthcare, and education expenses can be substantial. Additionally, Singapore's ageing population necessitates a focus on retirement security and healthcare planning.

Government Policies and Financial Planning

Singapore's government has implemented various policies to support financial planning. The Central Provident Fund (CPF) system, for instance, is designed to aid citizens in saving for retirement and healthcare. Understanding these policies is crucial when crafting a comprehensive financial plan.

The MoneyFitt Approach

MoneyFitt Services Overview

MoneyFitt offers various services, including financial goal setting, educating one for making investment strategies, insurance planning, and retirement planning through its guided steps, content and access to expert advice from Singapore’s licensed industry experts. These services are meticulously customised to cater to the specific needs of Singaporeans.

Singaporean Adaptations

MoneyFitt's approach is meticulously tailored to the nuances of the Singaporean financial landscape. They possess an in-depth understanding of the CPF system, local investment intricacies, and the challenges posed by the high cost of living.

Success Stories with MoneyFitt

Numerous individuals and families have achieved financial success through MoneyFitt's services. These success stories serve as testimonials to the effectiveness of MoneyFitt's approach, highlighting real-world examples of how their services have made a significant impact.

Key Components of Singaporean Financial Planning

In Singapore, financial planning comprises several crucial components that demand a closer look:

Tailored Goal Setting

Crafting financial goals that align with your lifestyle and aspirations is the foundation of a robust financial plan. MoneyFitt assists you in defining clear and attainable objectives.

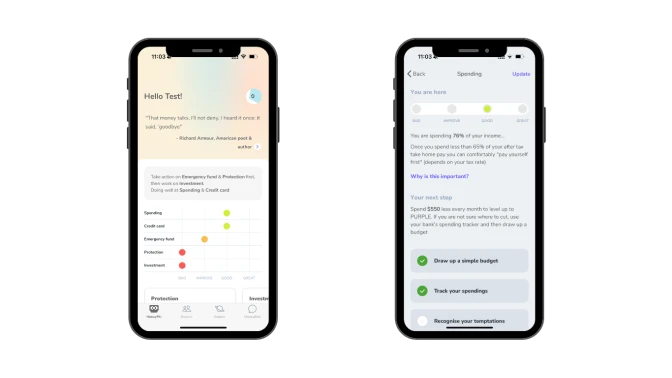

Financial Health Assessment

Assessing your current financial health is an indispensable step. MoneyFitt conducts thorough assessments to gauge your financial standing, identifying areas requiring attention.

Risk Management in Singapore

Singapore's unique risks demand specialised risk management. MoneyFitt provides strategies to safeguard your assets and investments against potential threats.

Budgeting in High-Cost Singapore

Budgeting is an indispensable skill in Singapore, where even daily expenses can be substantial. MoneyFitt assists in creating realistic budgets that strike a balance between living expenses, savings, and investments.

The MoneyFitt Advantage

Maximising CPF Benefits

MoneyFitt can help you maximise the benefits of the CPF system, ensuring you are well-prepared for retirement and healthcare expenses. Their expertise ensures you make the most of this vital government policy.

Singaporean Investment Insights

Navigating the investment landscape in Singapore can be complex. MoneyFitt provides valuable insights and strategies for making prudent and profitable investments, considering local market intricacies.

Retirement Planning with Local Schemes

Planning for retirement is paramount in Singapore's ageing population. MoneyFitt assists in navigating various local retirement schemes, ensuring your financial future remains secure.

Effective Insurance Planning

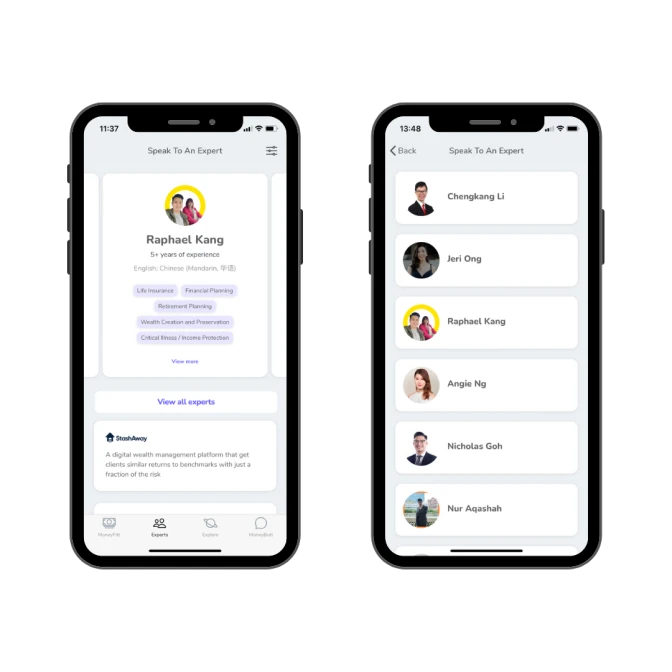

Insurance is a critical component of any comprehensive financial plan. MoneyFitt assists you in understanding the right insurance coverage and policies to safeguard your family and assets effectively, plus offers access to a matchmaking platform with experts who can understand and relate to your specific needs.

Tax Planning in Singapore

Tax Structure Overview

Effective tax planning is crucial for financial success. Understanding the tax structure is vital; use MoneyFitt’s tax content or consider expert guidance from on-platform experts to ensure optimal tax efficiency.

Tax-Efficient Investments

The experts on MoneyFitt’s platform can also provide valuable insights on which investments are tax-efficient in Singapore, helping you minimise tax liabilities while maximising returns.

Available Tax Deductions

Learn about the tax deductions available in Singapore and how to leverage them to reduce your overall tax burden fully.

Implementing Your Financial Plan with MoneyFitt

Tracking Progress with Tools

MoneyFitt equips you with tools to monitor your financial progress and adjust as necessary, ensuring you stay on course towards your financial goals.

Adaptations for Changing Circumstances

Life is dynamic, and MoneyFitt assists you in adapting your financial plan to changing circumstances, whether it's marriage, parenthood, career changes, or unexpected financial challenges.

Commitment to Financial Goals

MoneyFitt instils a commitment to your financial goals, offering the motivation and support needed to stay on track, even in the face of unexpected challenges.

Leveraging Professional Assistance

MoneyFitt's Financial Adviser Platform

MoneyFitt offers free access to a platform of financial advisers with the knowledge and expertise to guide you through the complexities of financial planning. Their personal touch ensures your financial plan aligns perfectly with your unique needs. MoneyFitt stands out from its competitors by not imposing fees on users for connecting with advisers and does not pocket commissions from transactions initiated with experts. This distinctive approach guarantees a straightforward and uncomplicated experience, making it an ideal choice for individuals searching for expert advice without the pressure of aggressive sales tactics.

CFPs in Singapore

Certified Financial Planners (CFPs) in Singapore play a pivotal role in financial planning. MoneyFitt can connect you with CFPs who provide expert guidance, ensuring your financial plan is in expert hands.

Avoiding Common Pitfalls

CPF and Retirement Neglect

Neglecting your CPF and retirement planning can be costly in the long run. MoneyFitt underscores the importance of this aspect of financial planning.

Understanding Local Investment Risks

Comprehending the unique investment risks in the local context is vital. MoneyFitt ensures you make informed decisions while mitigating potential risks.

Tax Implications Awareness

Awareness of tax implications is essential to prevent costly mistakes in your financial planning. MoneyFitt's content insights help you make tax-efficient decisions.

Regular Plan Review

Regularly reviewing your financial plan is essential to ensure it remains aligned with your evolving goals and circumstances. MoneyFitt emphasises the importance of ongoing assessment and adjustment.

Conclusion

Mastering financial planning in Singapore requires understanding the unique challenges and leveraging specialised services like MoneyFitt to achieve financial success. MoneyFitt's tailored approach, in-depth knowledge of the local landscape, and expert guidance are invaluable in helping you secure your financial future in Singapore.

We strongly encourage you to take action on your financial planning journey. Whether you're a young professional, a growing family, or planning for retirement, MoneyFitt can be your trusted partner in mastering financial planning in Singapore. Your financial security is well within reach with the right plan and guidance. Embrace Singapore's opportunities, and with MoneyFitt's expertise by your side, you can confidently chart a path towards a financially secure future.