Buying a House 101: One of Life's Most Significant Financial Goals

Rent or buy? Public or private? This guide answers your burning questions about buying a house

- Many factors determine whether you rent or buy a home, including affordability, eligibility, future plans, and level of commitment.

- According to experts, you should not be spending more than 30-40% of your monthly income on housing.

- When calculating whether you can afford a type of housing or not, consider upfront and ongoing costs.

Affording your place to live, whether that be to rent or buy, is a financial goal for most. Our living conditions, how affordable our house is, and the pressure to own property contribute to our well-being. This article will give you a good insight into public and private housing in Singapore, the buying process, and cover the renting vs owning property debate.

Renting vs Buying a Home

There is no straightforward answer when choosing between renting or buying a home. In our opinion, your best bet is to use the knowledge presented in this article to come to a sensible conclusion. Here’s a quick overview of the key differences between the two options.

Public Housing in Singapore (HDB)

The Housing and Development Board (HDB) manages Singapore's public housing under 99-year leases. Public housing is not a homogenous product, as HDB flats come in various sizes and layouts.

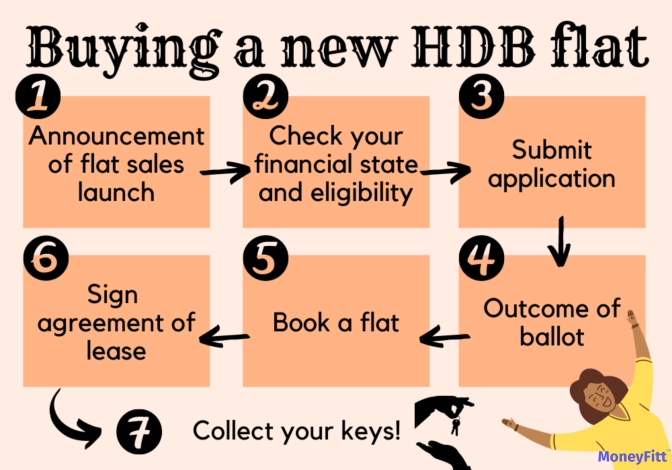

Process for Buying a New HDB Flat

Private Housing in Singapore

Private housing complements the widespread public housing to provide another option for Singapore residents. This type of housing includes condominiums and landed property. Unlike public housing, private property owners can be the freeholder of the land.

Are You Budgeting Well Enough to Afford a Home?

The OCBC Financial Wellness Index 2022 found that 40% of Singaporeans have problems paying their housing loans on time (amongst those with housing loans), indicating that too many are taking on housing they cannot afford.

Housing experts suggest homeowners or tenants should not spend more than 30-40% of their monthly income on housing to have money available for other essential needs such as food and transportation.

How Will You Finance a Home?

This is the starting point when purchasing any property. Will you need a loan to finance a home, or can you afford to pay in cash? Most people will need a loan. It is crucial to evaluate how much you could comfortably afford to spend every month on a mortgage payment.

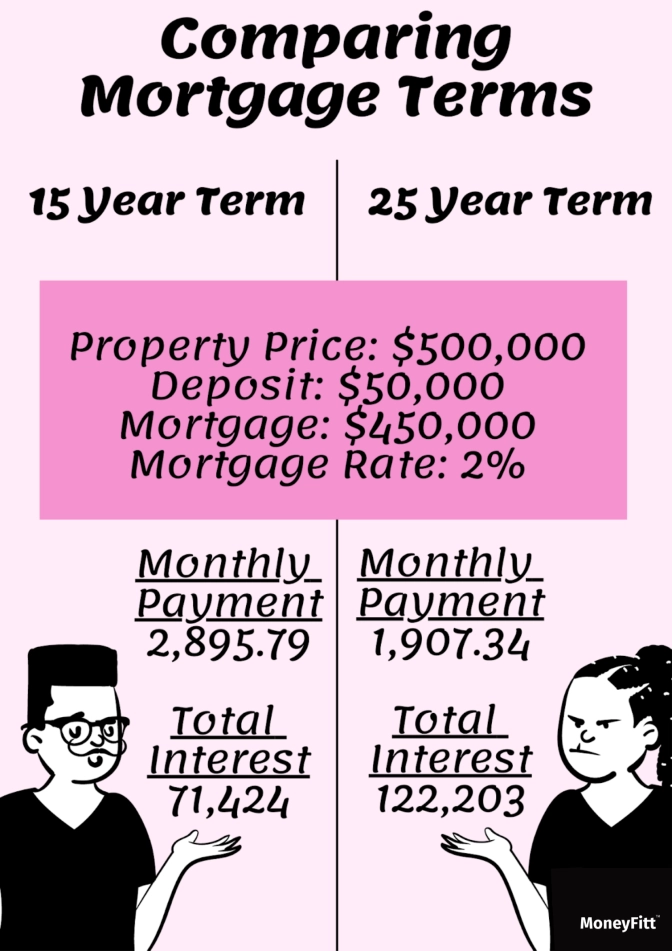

Maximum loan periods are capped at 25 years for an HDB flat using an HDB loan, 30 years for an HDB flat using a bank loan, and 35 years for a private property using a bank loan.

Remember: Property is a long-term commitment!

Tip ⭐️

A longer loan tenure means your monthly payment is lower for the same amount of money borrowed, but your overall interest is MUCH larger!

We do not recommend taking out new credit lines, such as a credit card, shortly before you plan on purchasing property, as this will likely impact your credit score.

To see HDB’s budget calculator, click here.

Loans

What Is a Home Loan?

You can borrow money from the Housing Development Board or a private financial institution (bank) to buy your property.

- Your property is used as collateral for the loan you take out

- The size of your loan is based on eligibility

- Your loan is disbursed after the down payment is paid

- You will be charged interest from the opening disbursement

For more information about housing loans, click here.

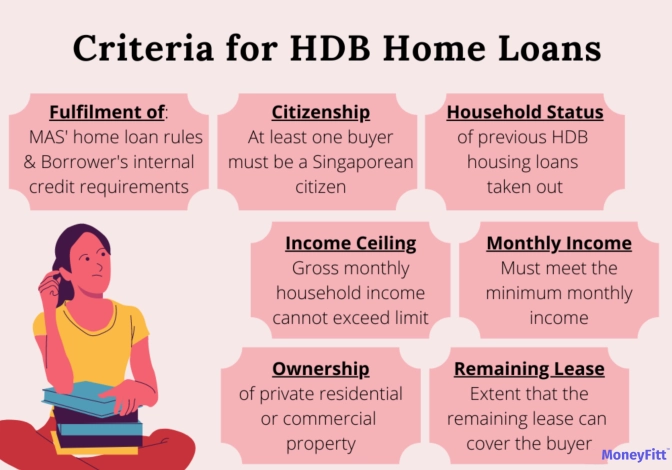

Eligibility for Home Loans

If eligible, HDB flats can be purchased with a loan from the HDB. You can borrow up to 85% of the property’s purchase or valuation price, whichever is lower. Any loan from a financial institution must be from one regulated by the Monetary Authority of Singapore. You cannot refinance any loan from a financial institution with an HDB housing loan later on.

Use the HDB Flat calculator tool here.

How Much Can You Borrow?

The lender will assess how much you can borrow using the following methods:

1. Mortgage Servicing Ratio (MSR)

- States the amount of your gross monthly income towards your mortgage repayment

- MSR = Monthly mortgage repayment/Gross monthly income

- Monthly instalments of both HDB and bank loans must not exceed 30% of gross monthly income

2. Total Debt Servicing Ratio (TDSR)

- States the amount of your gross monthly income used for monthly debt repayments.

- TDSR = Total monthly debt repayments/Gross monthly income

- Non-applicable for HDB loans, but for bank loans, your total monthly debt repayments must not surpass the TDSR threshold of 60%

3. Loan-To-Value Limits

- This determines the maximum amount you can borrow for a housing loan.

- LTV = loan amount/property value

- The lender will grant a loan after consideration of existing loans and credit facilities, your MSR, tenure of the loan, and any other rebates or other discounts granted

- LTV limit for an HDB loan is 90%, compared to 75% for a bank loan

What Is the Interest Rate on HDB/Bank Loans?

If you take out a loan from the HDB, the interest rate is fixed at 0.1% over the CPF Ordinary Account (OA) interest rate. The CPF OA interest rate is amended following the amendment of CPF interest rates. As of September 2023, the CPF OA interest rate is 2.5% (the legislated minimum rate.)

Suppose you take out a loan from a private financial institution. In that case, you have two types of home loans available:

Fixed-Rate Home Loan

- Unchanged rate throughout the lock-in period (1-5 years on average)

- Does not change even when market rates change

- Interest becomes variable following a fixed-rate period, pegged to a board rate, meaning that unlike in some other countries, these loans are not actually at a fixed rate for the life of the whole mortgage.

- At the time of writing in September 2023, rates are around 3.9% PA throughout the lock-in period.

- Suitable for those with low-risk appetites

Floating/Variable Rate Home Loan

- The interest rate varies and is often fixed to a reference rate such as the Singapore Interbank Offer Rate (SIBOR), Board Rate, Fixed Deposit Home Rate (FHR)

- More volatile than a fixed rate home loan

- Reference rate can change at any time and is influenced by market conditions

- Can lead to significant savings if interest rates take a nosedive, but of course, works the other way if rates shoot up

- Suitable for those who don’t mind a bit of risk

For more information on how home loans work, click here.

Can I Switch My Loan?

You can switch an HDB loan to a bank loan, but you can’t switch a bank loan to an HDB loan.

What Happens if I Pay the Loan Back Early?

Though this may seem a good idea, you could be penalised! If you’ve taken out a bank loan, you may incur fees for early repayment, so read the small print carefully or talk to an experienced professional, such as a mortgage broker. Fortunately, HDB loans have no such penalty.

Upfront Costs When Purchasing a Home

Option Fee

This fee reserves the flat that you wish to purchase and is non-refundable. The fee size depends on the flat:

Down Payment

This is paid when signing the agreement for the lease. The amount will vary depending on whether you are:

- Taking out an HDB housing loan

- Not taking any housing loan

- Taking a bank loan

Of the down payment sum, the amount paid in cash vs from CPF savings will be contingent on:

- The value and type of property

- Whether you have an existing housing loan and the length of the new loan

- The loan-to-value limit (loan ceiling) of the property

Third-party Costs

The valuation fee is a report on the property being financed.

The legal fee is for processing the mortgage on the property being financed.

The stamp duty is a form of taxation owed to the government for mortgage registration.

The insurance premium covers your property against multiple damages.

Ongoing Expenses for Housing

There will be ongoing expenses away from monthly home loan repayments. These should be budgeted for accordingly:

- Monthly expenses such as property tax, fire, service and conservancy charges, mortgage insurance

- Future interest rate hikes if you take out a floating rate loan

HOUSING 101. COMPLETED. ✅

Sources:

- https://www.google.com/url?q=https://blog.seedly.sg/cpf-interest-rates&sa=D&source=editors&ust=1621397318973000&usg=AOvVaw1DzTD7rOiiOcAfvJIwwx_4

- https://www.moneysense.gov.sg/articles/2018/10/understand-the-costs-of-buying-a-home?sc_lang=en

- https://www.hdb.gov.sg/cs/infoweb/residential/financing-a-flat-purchase/housing-loan-from-hdb

- https://www.hdb.gov.sg/residential/financing-a-flat-purchase/housing-loan-from-hdb/eligibility-conditions

- https://www.moneysense.gov.sg/articles/2018/10/how-home-loans-work?sc_lang=en

- https://www.propertyguru.com.sg/property-guides/additional-buyers-stamp-duty-guide-13034