5 Simple Steps to Take Control of Your Finances

In today's fast-paced world, where our attention is constantly pulled in different directions and our responsibilities seem never-ending, it's no surprise that our financial well-being often takes a backseat. However, we must recognise the immense significance of regaining control over our finances and effectively managing them. Financial control goes beyond mere numbers and budgets; it is the key that unlocks a life of freedom, security, and boundless opportunities.

Just imagine a life free from debt, where you can confidently plan for the future, and unexpected expenses no longer send you into a panic. It's an enticing thought, isn't it? Well, here's the good news: attaining financial control is well within your reach, and it begins with the best finance management platform - MoneyFitt.

This blog post will delve into these five steps that can transform how you approach your finances. By implementing these practical and actionable strategies, you will empower yourself to navigate the complexities of money management, develop a deeper understanding of your financial habits, and pave the way for a brighter financial future. So, let's dive in and uncover the secrets to mastering your financial destiny!

Mastering Your Finances: Essential Steps to Achieve Financial Control

Listed below are expert-backed steps from the MoneyFitt App to achieve financial control:

Step 1: Assess Your Current Financial Situation

A comprehensive understanding of your financial situation requires a thorough assessment of your income, expenses, assets, and liabilities. A clear picture of your financial landscape is crucial, including your income sources, recurring expenses, outstanding debts, and overall net worth.

This evaluation provides valuable insights into your financial well-being and lets you pinpoint areas requiring enhancement or careful consideration. By thoroughly assessing your financial status, you can pave the way for informed decision-making and take proactive steps towards achieving financial stability and prosperity.

Step 2: Set Financial Goals

Establishing financial goals is vital in charting a path towards your desired financial outcomes. According to experts from the MoneyFitt app, setting SMART goals - specific, measurable, achievable, relevant, and time-bound - enables you to define clear targets for your financial journey.

These goals include saving for a home down payment, debt repayment, building an emergency fund, retirement investment, or any other pursuit that aligns with your aspirations and priorities. By setting concrete and well-defined financial goals, you equip yourself with a roadmap that propels you towards achieving your dreams.

Step 3: Create a Budget and Track Your Spending

Creating a budget is a fundamental aspect of financial management. It involves creating a plan for allocating your income to various expenses and savings goals. A budget helps you control your spending, prioritise your financial objectives, and effectively utilise your income.

Tracking your spending allows you to monitor your expenses and identify areas where you may need adjustments to stay within your budget. It also helps you identify patterns or habits that can be modified to improve your financial situation.

Explore MoneyFitt's insightful articles and tools on budgeting, offering invaluable guidance and expert tips for crafting a robust budget and effectively monitoring your expenses.

Step 4: Reduce Debt and Save Money

Achieving financial stability and building wealth go hand in hand with two essential steps: reducing debt and saving money. To reduce debt, consider options such as consolidating your debts, creating a well-thought-out repayment plan, negotiating with creditors, or seeking professional assistance if necessary.

Saving money involves setting aside a portion of your income to meet both short-term and long-term financial goals. This may include building an emergency fund to handle unexpected expenses, saving for significant purchases, or investing for the future. By implementing these strategies, you can take control of your financial well-being and pave the way for a more secure and prosperous future. Click here to access a wealth of knowledge on money management online that can empower you to take control of your finances and achieve your financial goals.

Step 5: Seek Professional Guidance and Continuously Educate Yourself

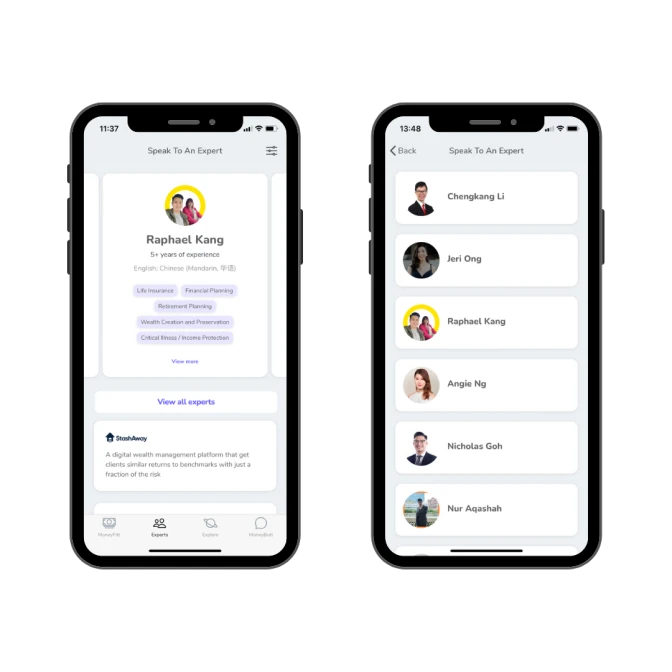

Unlock a wealth of knowledge and personalised guidance by seeking the expertise of financial advisors or experts who can offer valuable insights tailored to your specific financial situation. On the MoneyFitt app, expert advisors are available to provide comprehensive assistance on investment strategies, retirement planning, insurance policies, and other crucial aspects of personal finance.

Furthermore, staying informed about personal finance through resources such as MoneyFitt's articles, videos, courses, or newsletters ensures you remain up-to-date with financial trends, strategies, and best practices. This continuous education empowers you to make well-informed decisions, adapt effectively to evolving financial circumstances, navigate the complex realm of personal finance and maximise your financial well-being.

Conclusion

Mastering your finances is an ongoing journey that requires diligence, discipline, and a solid plan. By following the five simple steps outlined above, you can take control of your financial life and work towards a brighter future. The first crucial step is assessing your current financial situation, as it provides a clear picture of where you stand. Setting financial goals empowers you to create a roadmap and prioritise your actions accordingly. Creating a budget and diligently tracking your spending ensures you make intentional choices with your money and avoid unnecessary expenses. Reducing debt and saving money go hand in hand, allowing you to free up resources and build a stronger financial foundation. Finally, seeking professional guidance and continuously educating yourself keeps you informed and equipped to make sound financial decisions.

To streamline and enrich your financial journey, consider leveraging the MoneyFitt app, a comprehensive finance management platform that offers a wealth of resources, budgeting tools, and expert insights. Download the app today to seize control of your financial future and embark on a transformative path towards financial freedom and security.