5 Basic Financial Problem-Solving Strategies

Picture this: your financial journey is a winding road, full of unexpected twists and turns. Along the way, you encounter challenges that test your mettle, causing stress and uncertainty. Yet, the secret to a brighter financial future lies in mastering the art of effective financial problem-solving.

At MoneyFitt, we understand that navigating the complex world of personal finance can be as tricky as deciphering a cryptic map. That's why we're here to guide you through the process of financial planning.

In this post, we'll unravel the importance of becoming a financial problem-solving maestro. You'll discover how tackling common financial hurdles can transform your life. From budgeting woes to investment conundrums, we've got you covered.

But this isn't just another blog; it's your go-to resource for practical financial advice and solutions. MoneyFitt is your trusted companion, dedicated to equipping you with the tools and insights you need to make informed financial decisions. So, fasten your seatbelt, and let's embark on a journey to financial mastery together, where every challenge becomes an opportunity for growth.

The Solution of Financial Problems

1. Budgeting and Expense Tracking

Budgeting is the foundation of financial stability. It involves creating a plan for your income and expenses, allowing you to track where your money goes and make necessary adjustments. Start by assessing your income sources, whether it's your salary, freelance work, or other sources of income. Next, categorise your expenses, including essentials like housing, utilities, groceries, and discretionary spending like entertainment and dining out. Consider using MoneyFitt’s budgeting template.

Setting limits within each category ensures that you allocate your resources wisely. For instance, you may limit your dining-out expenses to a certain monthly amount. By sticking to your budget, you can identify areas to save and redirect those funds toward achieving your financial goals.

Consider a real-life example: Sarah, a working professional, struggled to save money until she created a budget. By diligently tracking her expenses, she discovered she was spending more on impulse purchases than she realised. With a budget in place, she could cut down on unnecessary expenses and save for her wedding.

2. Debt Management

Excessive debt can be a significant roadblock to financial success. High-interest debts, such as credit card balances, can accumulate quickly and become burdensome. To manage and reduce debt effectively, prioritise paying off high-interest debts first. Negotiate with creditors to explore options for lower interest rates or extended repayment terms.

Consistent payments are crucial for debt reduction. Create a debt repayment plan that fits your budget and stick to it. Additionally, consider debt consolidation a viable option to streamline your debts into a single, more manageable payment. Debt consolidation can simplify your financial life and reduce the overall interest you pay.

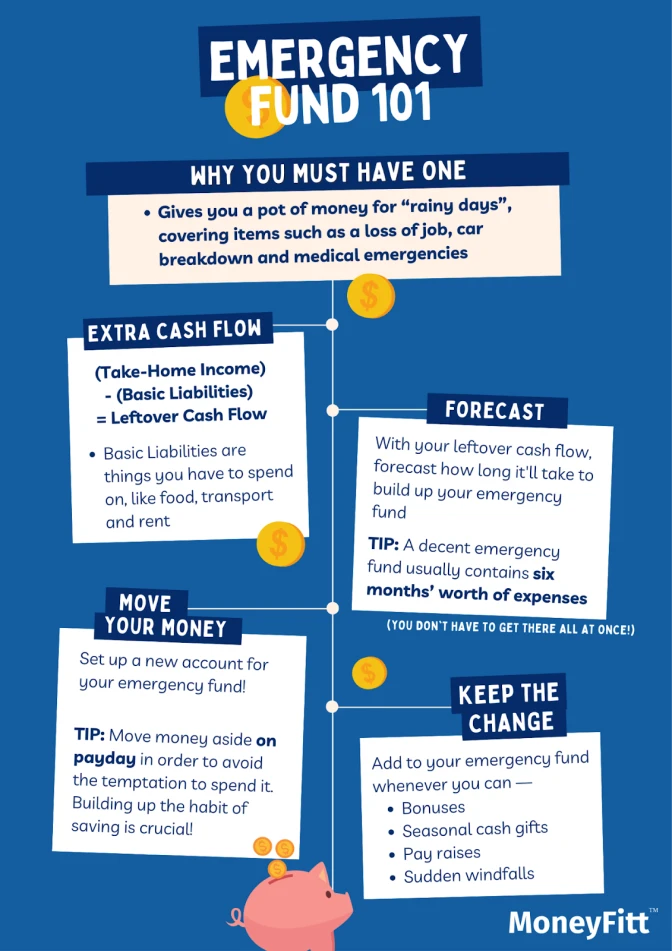

3. Emergency Fund Planning

Life is unpredictable, and unexpected expenses can arise at any time. That's where having an emergency fund becomes crucial. Calculate the ideal size of your emergency fund based on your monthly expenses. Experts recommend saving three to six months' worth of living expenses.

To build and maintain an emergency fund, automate contributions by setting up automatic transfers from your checking account to a dedicated savings account. This financial safety net can prevent you from going into debt or using credit cards when unexpected emergencies, such as medical bills or car repairs, occur.

Consider the story of Mike, who was faced with a sudden job loss. Thanks to his well-funded emergency fund, he could cover his living expenses while searching for a new job, avoiding financial stress during a challenging time.

4. Investment and Retirement Planning

Long-term financial planning is essential to secure your future. One of the most effective ways to grow your wealth is through investments. Begin by learning the basics of investing, including different asset classes like stocks, bonds, and mutual funds.

Start early with retirement planning, as time is your most valuable asset in investing. The power of compound interest allows your investments to grow exponentially over time. Explore retirement account options like CPF or other retirement account options available in Singapore to take advantage of tax benefits while saving for retirement.

MoneyFitt offers resources and tools to help you understand investment options and create a retirement plan tailored to your goals and risk tolerance.

5. Lifestyle Adjustments and Seeking Professional Finance Advice

Your lifestyle choices have a significant impact on your financial well-being. Setting clear financial goals and prioritising your spending accordingly can help you align your actions with your objectives. Consider what truly matters to you and allocate your resources accordingly.

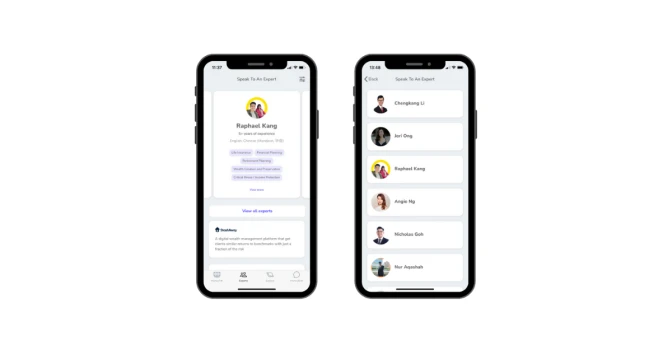

Sometimes, it's beneficial to seek professional financial advice. Financial advisers can provide personalised guidance based on your unique financial situation and goals. With MoneyFitt's Find an Expert feature, you can connect with the expert of your choice who can assist you in selecting the right financial adviser to help you navigate complex financial decisions. Free of charge, commitment free, and optimised for Singapore.

Conclusion

Effective financial problem-solving is vital for achieving long-term stability and success. You can take control of your financial future by implementing these five basic financial problem-solving strategies that are important for proper money management —budgeting and expense tracking, debt management, emergency fund planning, investment and retirement planning, and lifestyle adjustments.

Remember that proactive financial management is the key to overcoming common financial challenges. MoneyFitt is here to support you on your journey toward financial planning in Singapore. Explore our resources, tools, and personalised advice from experts to make informed financial decisions and secure a brighter future for yourself and your loved ones. Take the first step today and embark on your path to financial success with MoneyFitt.