Credit Cards 101: Are They a Source of Debt or a Financial Tool?

Simplifying payments with swipes and taps, but not without danger!

- Credit cards are a form of short-term borrowing that enables you to borrow up to the credit limit, set by the lender (usually a bank). Credit cards can be an easy way to get interest-free loans, valuable rewards, travel perks and shopping benefits. If used correctly, they can also help you build your credit score.

- But the costs far outweigh the benefits if you don't pay off your whole balance each month. Any interest owed will quickly compound and credit card companies usually charge very high interest rates in the first place!

- Credit card companies make most of their money from charging interest to cardholders who do not pay off their bills completely and on time. Make sure you’re not one of them!

You’ve probably heard about the amazing (and dangerous) things credit cards do. On one hand, they can grant you bonus miles on your flights or cashback on your cinema tickets. On the other, they can fuel spiralling debt and have creditors chase people down, as you see in movies.

The truth is that like any tool, there’s no doubt that they can be very helpful or very dangerous, depending on how you use them. But wait, what exactly are credit cards?

What Is a Credit Card?

A credit card is a form of borrowing that allows you to borrow up to the credit limit set by the credit card company. Whatever you pay using your credit card (also known as charging to your credit card) goes into the outstanding or unpaid balance. It represents what you owe the bank.

In Short: Why People May Want to Use Credit Cards?

- Help build your credit score

- Allow you to take out interest-free “loans”(if repaid within grace period)

- Earn valuable rewards

- Provide shopping benefits and travel perks

- Let you worry less about fraud (if used correctly)

Available credit in the credit card is the amount you can spend before you hit your credit limit. If your credit limit is $1,000, and you’ve already charged $300 to your card, your available credit is $700. If you make a $200 payment, the credit limit will go back up to $900. (This is why it has the name “revolving” line of credit).

Here are some other common types of credit card, besides the vanilla, bank-issued ones (many of which also offer points, perks and rewards):

Reward credit cards offer rewards for their users, including cashback, statement credits or points for flights and hotel stays with selected partners. The rewards keep getting better with time and responsible usage. Nowadays, merchants collaborate with credit card companies to offer benefits like cashback, shopping offers and minimum purchase rewards to customers - sometimes issuing their own, reward cards. These act as customer incentives to enjoy more sales and customer loyalty. Such cards offer benefits centred around their target audience.

Whereas most credit cards are “unsecured,” secured credit cards are meant for riskier borrowers who may be more likely to default on their borrowing. As such, to get these cards, a security deposit is needed. An upfront deposit serves as your credit limit. The credit limit is usually about 80% to 100% of the fixed deposit collateral.

Charge cards are not credit cards but are not too dissimiliar. The main difference is that you can’t carry a balance from month to month, meaning you must always pay the statement balance in full by the due date.

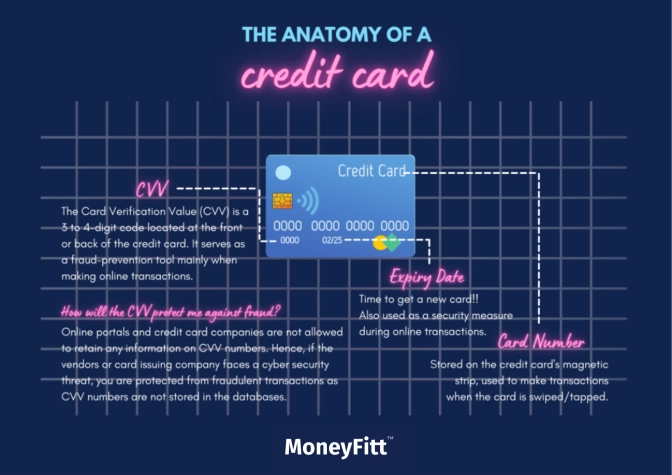

The Different Parts of a Credit Card

- Card Number is an identification number stored on the chip or magnetic strip of your credit card. It is used to make transactions when the card is tapped or swiped.

- Expiry Date defines when it’s time to get a new card! Also used when buying online as a security measure.

- CVV is a 3- or 4-digit code usually located on the back of your card. It serves as a fraud-prevention tool when making purchases that don’t involve a physical card, such as with online shopping. Nowadays, of course, many use 2-factor authentication as well, using alerts sent to your phone.

You can apply for a credit card from any credit card issuer or bank. The credit card issuer or bank will then assess your income and repayment ability by, among other things, reviewing your credit report. If your application is accepted, you'll receive a card with a fixed credit limit.

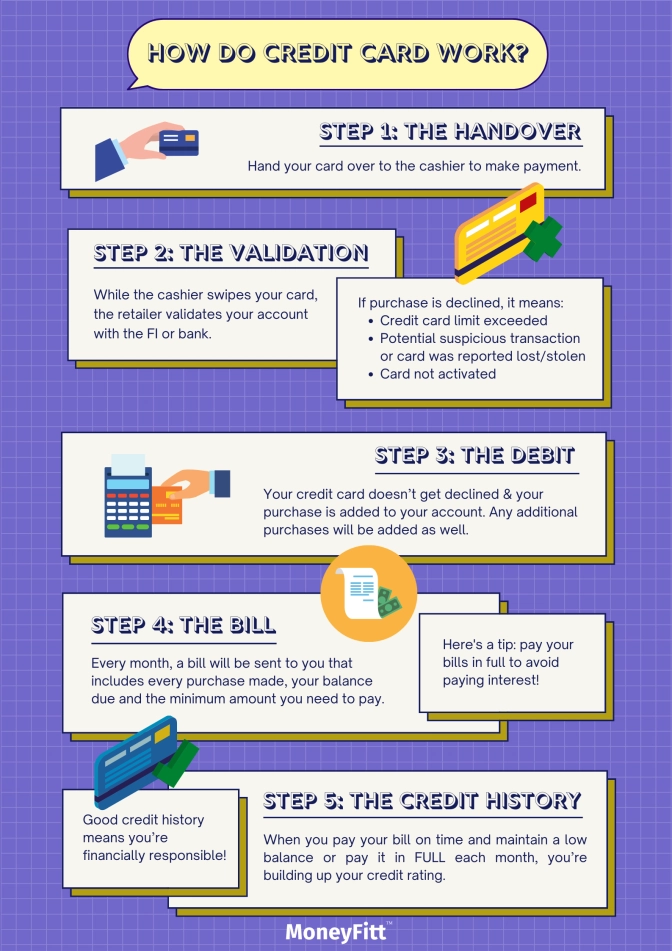

How Credit Cards Work (Generally):

#1 Handover: You make payment with your card.

#2 Validation: The merchant then sends your information out over a secure internet connection to validate your account and confirm with the issuing financial institution (FI) or bank whether to let the purchase go through or not.

#3 Debit: assuming that your credit card isn’t declined, then the purchase price is debited from your account. You get your stuff, and the merchant gets paid minus some processing fees. Every time you repeat Steps 1 through Step 3, your additional purchase amounts are added to your account. At the end of the month, you’ll have to pay up via Step 4.

#4 Bill: every month, the FI or bank that issued your credit card will send you a bill that includes every purchase made during that month. The credit card issuer will show your balance due and the monthly minimum amount owed.

If you just pay the minimum amount (or anything other than the full amount), you will incur a financing charge for the remaining balance. Interest for the balance is calculated starting from the statement due date and will be reflected in your next monthly statement. If you keep on paying only the minimum amount due every month, your financing charge (i.e. the interest) is compounded. This can turn out to be very, very bad news as the interest rate tends to be very high.

The Effect of Paying the Minimum Balance Each Month:

Say, you recently got a credit card with a credit limit of $5,000. The monthly spending on the card is about $1,000, the interest rate is 25% per annum, and the minimum balance that has to be paid monthly is $50.

The graph below shows that by only paying the minimum balance, you’ll end up incurring $2,398 worth of interest on the credit card in just two years!

However, paying off your statement balance in full each month means you can completely avoid paying any interest. That’s because most credit card companies don’t charge any interest until after your statement’s due date. So if you pay the bill in full, you won’t pay a penny in interest. This “grace period” is one of the best things about responsible credit card use.

#5 Credit History: An underappreciated but very important part of using credit cards. Every time you pay your credit card bill on time, maintain a low credit card balance or (preferably) pay your balance in full each month, you’re building up your credit rating. Having a good credit history shows banks and other financial institutions that you’re financially responsible, which will make it easier and cheaper for you to borrow money for major purchases (such as property or a car) in the future.

Most Credit Card Companies Check Eligibility Based On:

- Age

- Residency

- Employment and income

- Credit history

Key Terms and Features

- Annual fees: a membership fee to receive and use your credit card. Most cards have this, but many of those will have an easy way for you to call the bank to waive those fees each year. Card companies make money from you in so many other ways, after all, so they would do their best not to lose you. (It's incredibly wasteful if you don't take advantage of this fee waiver facility!)

- Monthly statement: (i.e. bill) containing details of your monthly credit card spending. The payment due date is when the bank must receive full payment of your credit card bill to avoid incurring interest and late charges.

- Foreign currency transactions: overseas purchases get converted from the local (overseas) currency into your own home currency in your statement. The foreign exchange rates used may vary daily and from bank to bank. They also usually include currency conversion charges or other administrative fees. Credit card exchange rates are usually horrible, so consider getting an e-wallet, as they have more consistently competitive and transparent exchange rates.

- Free credit period before the due date: upon receiving your monthly credit card bill, you’ll have a 20-25 day period, known as a free or "grace" period, to pay it (as long as it's by the due date) before the bank charges any interest or late fees.

- Minimum sum for payments: by only paying the minimum sum due, the rest of your credit card balance will incur interest charges. One "trick" to avoid is the option to automatically pay only the minimum amount so you can avoid late charges. If offered the option to make payment of the entire Statement Balance, do that instead.

- Gifts and rewards: compare the different calculations of bonus points as banks have different reward schemes. Specific terms and conditions always apply. One popular strategy is actually to "Earn and Burn", which means don't sit on your points to let them build up - sometimes they expire worthlessly!

- Credit card instalment plans: anything purchased on a credit card instalment plan must be settled in full. Even if the merchant fails, you’ll have to keep paying the monthly instalments until the full payment settlement.

Repercussions of Not Paying Your Credit Card Bills (Partly or in Full)

While it’s not abnormal to suffer a cash crunch, it’s important to understand that not paying your credit card bills is not a way out. In fact, it's one of the worst things you could do. Credit cards are not designed for long-term loans, at least from the cardholder's perspective, given the high interest rates they charge (APR). If you do absolutely need to borrow money, instead consider personal loans (as these typically have lower interest rates).

If, for whatever reason, you really can't afford to pay your credit card bills, suggestion #1 is to act quickly, while you may still have time to regain some control over the situation. Swallow some pride and contact your credit card company (or companies) to clarify the issue and devise a plan, as many offer some assistance, including skipping a few payments without penalty or possibly reduced interest rates. In most places, you could also contact a free, nonprofit credit counselling service for more guidance.

We recommend that you use credit cards as a mode of payment only. In other words, use your credit card to purchase things and also get rewards and discounts at the same time. However, pay off your monthly bills in full (and, importantly, on time) so there is no interest charged. Paying just the minimum or making late payments are a bad habit to slip into. The amount owed from interest and late payment fees will accumulate the longer you leave your credit card balances rolling over. Credit card interest rates can make it easy for debts to snowball into an amount you can’t manage.

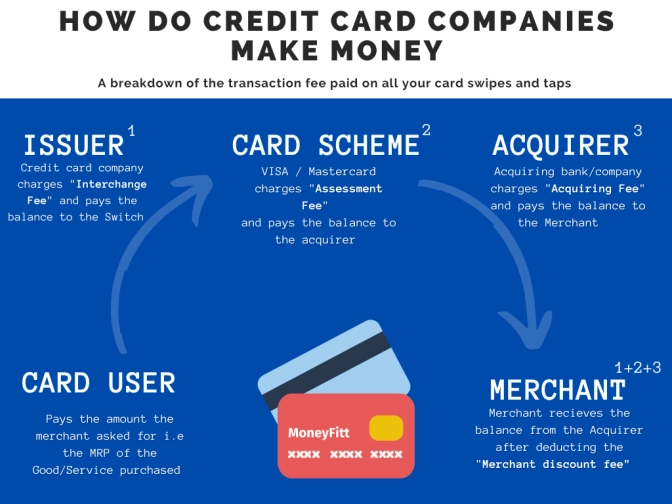

How Credit Cards Companies Make Money

Factors to Consider When Getting a Credit Card

- Lifestyle and spending habits: are you a frequent traveller? Do you dine out often? Evaluating your lifestyle and understanding your spending habits will help you choose the right card that will best complement your needs.

- Sign-up bonus: A lot of credit cards offer special bonuses when a new user meets a specific requirement. For instance, receive 85,000 air miles when you spend $4,000 in the first 3 months. Consider this: can you comfortably spend this amount in this time frame? If not, you won’t be getting any of the bonuses.

- Rewards: some credit cards offer fixed percentages towards their rewards program or higher percentages for specific categories and merchant partners (e.g. cashback for petrol station transactions).

- Annual fee: there are credit cards that require an annual membership fee. Evaluate for yourself if it’s worth paying, considering that it probably comes with several perks you can maximise to offset the cost.

- Annual Percentage Rate (APR): this is the interest rate on the outstanding balance. Some credit cards offer low promotional APRs initially, which then eventually rise after you’ve had the card for a year or more. Thankfully, you won’t have to worry about APRs if you’re punctual in fully paying your credit card every single month.

Before applying for a credit card, you should first consider whether you’ll be able to use it responsibly. Will you only charge what you can afford, so you can pay the balance on time and in full each month? So if you can utilise credit cards responsibly, then they’re powerful financial tools that can serve you for years to come.

The Main Thing to Remember

Credit cards exist so that credit card issuers can make profits from their customers.

The customers who make credit card companies their profits are those who pay late fees and interest. Credit card companies make significantly more money from interest charges than they do from fees (paid by the merchants accepting their cards. Basically, these poor, unfortunate, interest-paying victims pay for all the costs of running the business* and more. Don't be one of them!

* These costs include running the business for all cardholders, including the smart and disciplined ones who pay off their balances on time every month and therefore don't pay any interest or late fees at all... hopefully cardholders like you!

A GUIDE TO CREDIT CARDS. COMPLETED ✅

SOURCES

- https://www.investopedia.com/articles/pf/10/credit-card-debit-card.asp

- https://learn.moneysmart.sg/credit-cards/credit-card-basics/how-do-credit-cards-work/

- https://www.moneysense.gov.sg/articles/2018/10/understanding-credit-cards

- https://www.creditcardinsider.com/blog/how-does-a-credit-card-work/#are-credit-cards-a-good-idea

- https://www.moneysmart.sg/credit-cards/credit-card-bank-application-basics-ms

- https://www.singsaver.com.sg/blog/what-happens-when-you-cant-pay-your-credit-card

- https://gendal.me/2014/08/09/