4 Suitable Investment Choices for Working Professionals

Are you looking to invest the money you worked hard for? The decision of which investment option is right for you may be overwhelming, given how many are available. This article presents four of the most popular, easily accessible investment choices for working professionals in Singapore. These choices are beneficial for working professionals as they are relatively easy to start with. A solid investment portfolio can better secure your financial future and aid in building wealth.

Before investing, consider your risk appetite, time horizon, and financial situation.

Your financial objectives and priorities can be accomplished with an appropriate investment plan. Building a nest egg, saving for your children’s tertiary education or even retirement is included. Why wait, then? Your financial future should be planned today!

Singapore Savings Bonds

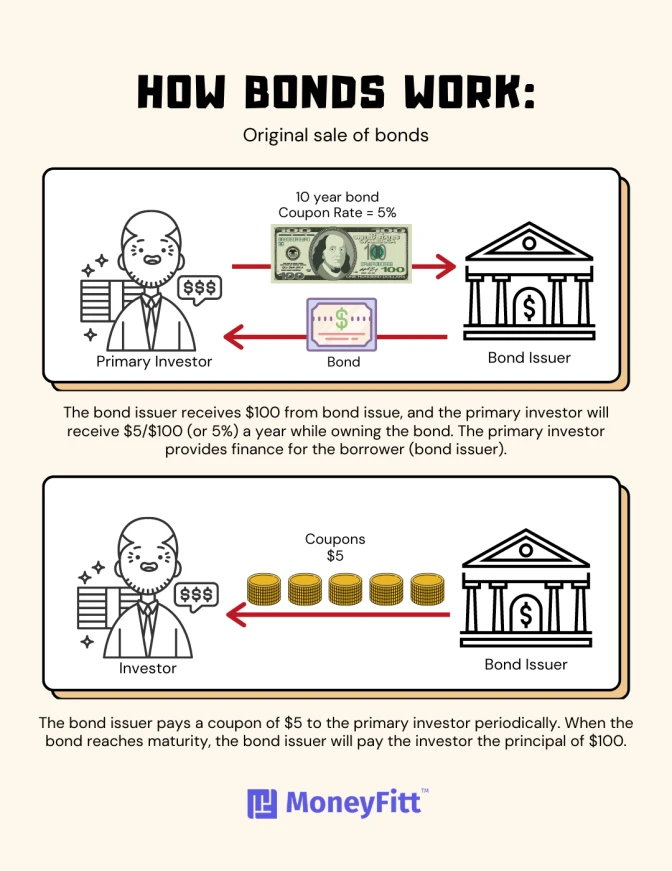

Investing in bonds means lending money or buying an existing loan to the bond issuer. In return, you receive a fixed payment called a "coupon" for a specified period. Bonds have two types of payments: the return of the principal when the bond matures and periodic coupon payments. These payments usually remain fixed throughout the bond's life.

There are risks associated with investing in bonds, including a decrease in market value due to rising interest rates, the possibility of the issuer defaulting, and inflation surpassing coupon rates. When interest rates increase, the price of a bond decreases, and vice versa.

The MAS (on behalf of the Singapore government) issues and backs Singapore Savings Bonds (SSBs), which are considered a flexible, risk-free investment option. The following are important qualities of SSBs:

- SSBs provide step-up interest rates. If you keep the bond for an extended duration, the interest rate you'll receive will be greater (but the coupon remains fixed).

- The investment amount starts at S$500 and can be invested for up to 10 years.

- You can exit the investment without the risk of any penalty or loss of the invested capital at any given time before the bond matures.

- SSBs are considered a secure investment as the Singapore government issuing them has been rated AAA.

This investment option is suitable for investors seeking flexibility and the potential for increasing interest rates over time, with a maximum maturity period of 10 years. It is also suitable for those who wish to invest up to $200,000 using cash or SRS funds and do not want to incur penalties for early redemption.

Other investment alternatives like ETFs or REITs usually have higher returns than SSBs, which typically offer lower rates ranging from 1% to 3%. Considering other options may lead investors to higher returns. However, it is important to note that with higher reward comes higher risk.

Unit Trusts

A unit trust, or mutual fund, is an investment vehicle where individuals buy various securities, including shares, bonds, and other financial products.

Diversification is a major benefit of investing in unit trusts since they can allocate your funds across various asset classes and global markets. Using this can assist in investment risk management.

The funds are often highly liquid, meaning you can easily withdraw your money if you wish to.

Fund managers handle the management of unit trusts professionally. They possess experience, a team of analysts and the means to make educated investment choices for the investors.

Things to consider

Diversification is not assured, and it is important to note that a unit trust might concentrate its investments on a specific industry, country, or type of share. Although narrowly focused unit trusts can be appealing investments, it is crucial to consider them as part of a broader and more diversified portfolio.

Like other investment products, fees might be associated with unit trusts. These fees comprise management fees and sales charges. Understanding the fees associated with a unit trust before investing is paramount.

The market offers various types of unit trusts. Each has its investment strategy, risk profile, and underlying assets. Pick a unit trust that matches your investment goals and risk tolerance.

Usually, unit trusts are bought from the fund management company running them (e.g. HSBC) or from a bank/broker who will do so on your behalf (e.g. Phillips). Before deciding on an investment, one should understand the unit trust's functionality, hazards, and fees.

Exchange-Traded Funds

An Exchange-Traded Fund (ETF) operates similarly to a unit trust, pooling investor funds and allocating them into multiple securities. However, unlike unit trusts, ETFs are traded on stock exchanges, requiring transactions through a broker. ETFs have gained significant popularity since their introduction in the mid-1990s due to their low fees and high liquidity.

The range and variety of ETFs have been snowballing. The most popular ETFs are passive funds that aim to replicate established stock market indices like the S&P 500, FTSE100, or MSCI AC Asia Pacific Ex Japan Index. These ETFs do not rely on expensive fund managers to research shares or time trades, resulting in significantly lower costs for investors.

ETF prices can be volatile during the trading day, mirroring changes in the underlying securities. Occasionally, the ETF price may deviate from the value of its underlying assets due to investor supply and demand dynamics.

Lower fees are a key advantage of ETFs, with investors only paying brokerage commissions for buying and selling ETFs through a broker.

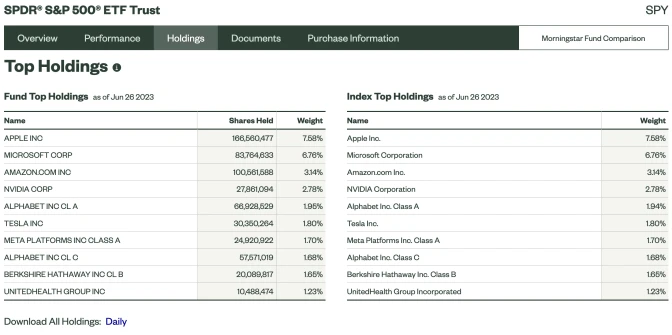

The SPDR S&P 500 ETF Trust is the world's most popular ETF regarding assets under management, tracking 500 large and established US companies. Below you can see the top holdings under this ETF:

Investors have various options, including Bond ETFs (e.g. Vanguard Total Bond Market ETF), Commodity ETFs (e.g. SPDR Gold Shares ETF), and Sector ETFs (e.g. Vanguard Energy ETF).

Singapore REITs

Singapore Exchange (SGX) is where you can find Singapore Real Estate Investment Trusts (S-REITs) and regular REITs. S-REITs make earning rental income from properties possible for investors who wish to co-own a portion of the Trust’s real estate. The rental income is regularly distributed as the yield distribution. For those in Singapore, REITs are a favoured investment option providing access to diverse property investments domestically and abroad. Various investment opportunities exist for S-REITs:

- To invest in Singapore REITs, you can do so directly through brokerages. Simply invest in REITs listed on the SGX. You can buy this equity like any other through trading platforms like DBS Vickers.

- Investors can invest in a collection of REITs by buying unit trusts.

- Choose to invest via REIT ETFs. One can obtain REIT exposure via REIT ETFs such as the Nikko AM-StraitsTrading Asia ex-Japan Reit ETF.

- Syfe’s REIT+ Portfolio that tracks the SGX's iEdge S-REIT Leaders Index. Investment is made in a diverse collection of S-REITs.

An essential step in selecting REITs is considering all options and creating a standard for assessing Singapore REIT performance across different timeframes. Choosing a REIT necessitates the consideration of certain aspects:

1. Sector of the economy: The REIT sectors experience differing impacts due to varying economic conditions. REITs are available in numerous sectors, such as commercial, healthcare, and retail.

2. Yield: REITs are known for their strong yields. The income you receive from S-REITs/REITs comes from their yield. In Singapore, REITs pay an average of 7.6% in yield.

3. Sponsor: The REIT's performance can benefit from quality assets, which a strong sponsor, usually a large real estate company, can provide.

Despite the potential risks, REITs are a solid option for long-term investing. Diversifying your portfolio and performing thorough due diligence are essential steps to manage risk for investors.

Final words

In conclusion, the four investment choices for working professionals discussed offer working professionals various options to meet their financial goals. Among the available options are Singapore Savings Bonds (SSBs), Unit Trusts, ETFs, and S-REITs. Starting to invest in your future can be informed by carefully considering your unique financial situation and goals.

Your financial future can be secured by taking action and beginning investing now. To determine the investment plan that best meets your requirements, further educate yourself on the fundamentals of investing through MoneyFitt’s content. Take action and get MoneyFitt today!