Bonds: Singapore Government Securities and Singapore Savings Bonds

The name's Bond, Singapore Savings Bond

- By investing in bonds, you are lending money (or buying an existing loan made) to the bond issuer in return for an agreed "coupon" (a fixed payment) for a specified period.

- A bond usually involves two types of payment: the return of principal (the face value of the bond, not what you paid for it) when the bond "matures", i.e. when the principal is supposed to be paid back in full, and coupon payments throughout the life of the bond (known as "fixed-income investments" because the coupon is fixed at issue and doesn't change).

- The main risks to investing in bonds include a rise in interest rates lowering the market value of bonds, issuer default and inflation exceeding coupon rates. The price of a bond goes down when interest rates rise and vice versa!

Singapore Government Securities (SGS) and Singapore Savings Bonds (SSB)

Both are bonds issued by the MAS for the Singaporean government. They are considered risk-free as the Singapore government has an AAA credit rating (the highest possible rating). Bonds are issued by governments to investors as a way of borrowing money to fund public spending (among other reasons).

Singapore Government Securities

Singapore Government Securities come in the form of Treasury bills (T-bills) or SGS bonds. T-bills mature within 12 months, whereas SGS bonds have maturities of 2-30 years. Suitable for investors who want:

✅ A fixed interest rate and a maturity of 6 months to 30 years

✅ To be able to trade on the secondary market

✅ No investment limit

✅ To invest using either cash, SRS or CPFIS funds

Investing in Singapore Government Securities

To purchase, you will need:

- To be aged 18 or over

- A bank account with one of the following local Singapore banks: DBS/POSB, OCBC, or UOB

- An individual CDP securities account. We recommend also setting up a Direct Crediting Service to link the CDP account to your bank account

- To decide whether you wish to make a competitive or non-competitive bid:

Competitive - you bid on it based on a specific yield that you want, expressed in percentage terms, up to two decimal places.

Non-competitive - you bid based on the amount you wish to invest, not the yield. Suitable for those who are not fussy about the exact yield they receive.

How Are SGSs Bought?

Either bidding in a primary auction or trading through the secondary market buys Singapore Government Securities. Primary auction applications can be done through:

- Eligible banks’ ATMs

- Internet banking services (plus mobile banking in OCBC’s case). Have your CDP account number at the ready!

- SRS/CPFIS funds. For SRS funds, this will be through your SRS operator’s online banking service, whereas using CPFIS funds requires an in-person application at your agent bank's main branch

- The minimum investment required and unit size of each bond is $1,000

You’ll be able to tell whether you were successful or not on the MAS website roughly an hour after the auction has closed. SGSs are issued to successful bidders three days after the auction.

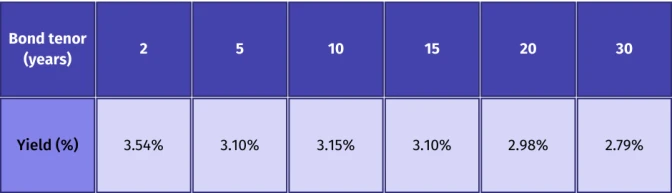

Current SGS Yields:

Singapore Savings Bonds

Suitable for investors who want:

✅ Flexibility with their investment

✅ Increasing interest rates the longer they hold (max 10-year maturity)

✅ A maximum investment of $200,000

✅ To use cash or SRS funds

✅ Do not want a penalty for early redemption

Investing in Singapore Saving Bonds

To purchase, you will need:

- To be aged 18 and over

- A bank account with one of the following local Singapore banks, DBS/POSB, OCBC, or UOB

- An individual CDP securities account. You also need to set up a Direct Crediting Service to link the CDP account to your bank account

How Are They Bought?

Each month, on the first business day, a new Singapore Savings Bond is issued. Applications can be made through:

- Eligible banks’ ATMs

- Internet banking services (plus mobile banking in OCBC’s case). Have your CDP account number at the ready!

- SRS funds. For SRS funds, this will be through your SRS operator’s online banking service

- The minimum investment required and unit size of each bond is $500

The application window closes on the fourth last business day of the month. You’ll be able to tell whether you were successful or not on the MAS website on the third last business day of the month. SSBs are issued on the first business day of the next month.

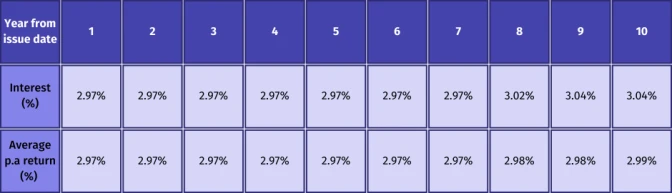

Current SSB Yields:

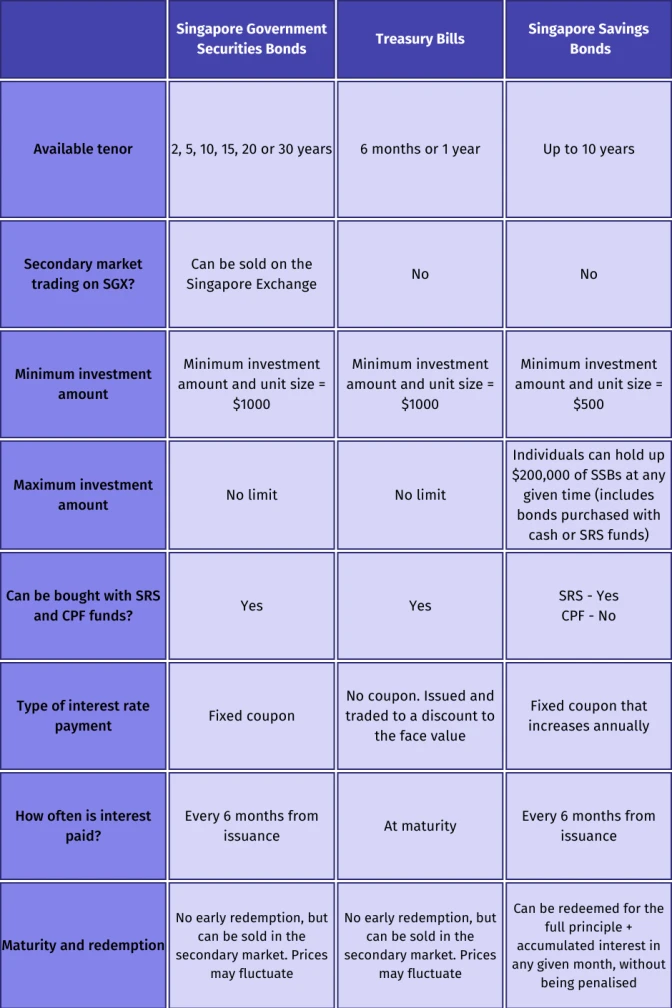

SGS Bonds, T-Bills and SSBs Compared

Tax Exemption 🚨

A reminder that because there is no capital gains tax in Singapore, all gains made from investing in bonds are exempted from tax!

Where Do I Buy Bonds?

You can buy bonds either in the primary market, where the bond is created and priced at face value, or through the secondary market via a bank or broker which may have the bond in its inventory or, in some cases, through a regulated exchange (e.g. the Singapore Exchange), assuming there is a seller. The secondary market purchasing process, if through an exchange, is very similar to buying shares through a brokerage platform, meaning it will involve brokerage fees. Any bonds purchased are reflected in your SGX CDP account. Buying from a bank or broker, on the other hand, would involve paying the spread between bid and offer prices.

How Do I Sell a Bond?

You can either receive the principal at maturity or sell it on the secondary market before maturity (assuming that there is a buyer). Of course, if the issuer of your bond defaults before it reaches maturity, then you may receive nothing.

BONDS: SGSs and SSBs. COMPLETED. ✅