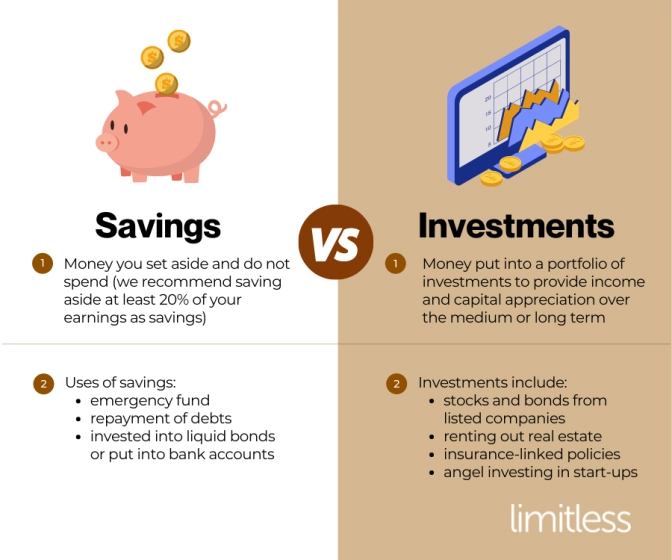

What's The Difference Between Savings and Investments?

Money for a rainy day versus money used to grow more money!

What are savings?

Savings are what you set aside and do not spend from your income.

The 50-30-20 Rule says that you should (according to the CFPB in the US) spend:

- 50% of your income on essentials (e.g. rent)

- 30% on discretionary items (e.g. gym membership, dining out)

- 20% towards your savings and investments (e.g. savings account, stocks and bonds)

We would change the order, prioritise at least 20% of your income for savings, and deal with the rest as best you can. (More than 20% would be excellent but start with anything you can.)

Note that this 20% should be used first for paying down high-interest debt (e.g. credit cards, payday loans, unlicensed loan sharks, perhaps personal loans and BNPL), then for an emergency fund of three to six months of your take-home pay so you can survive future "rainy days".

If you're lucky enough to get significant raises every year, you would probably need a nine-month emergency fund now based on your current income!

Some of your emergency fund should be available at short notice, but the rest should be in higher interest-bearing accounts at the bank (perhaps not your main bank, to reduce temptation.)

What are investments?

Investments are assets acquired or invested with the aim of generating income or appreciating in value.

Invest the rest of your salary minus expenses into a diversified portfolio of investments that not only beat inflation but provide income and capital appreciation over the medium to long term for future use (such as but not only retirement.)

Your investments are your "nest egg" - grow them! There are many exciting and not-so-exciting choices to pick from. You could do the following:

- Purchase stocks of public-listed companies on stock exchanges— for example, Tesla stocks from NASDAQ and hold on to the stock for price appreciation

- Invest in dividend stocks that pay out interest quarterly or annually

- Invest in a unit trust/mutual fund or Exchange Traded Fund (ETF)

- Invest in property through Real Estate Investment Trusts (REITs) or buy a house to rent out or eventually sell at a profit

- Buy an Insurance-Linked Policy (ILP), an insurance plan bundled with an investment fund that pays out a guaranteed sum plus a share of the fund's profits

- Invest as an Angel investor in an early-stage start-up

Investments come with varying levels of volatility which you learn to stomach in return for better returns. As a rule of thumb, risk is proportionally correlated to return, so the higher the risk, the higher the expected return. This is called the risk-return trade-off.

For example, bonds and US T-Bills are among the safest asset classes there are, which correlates to a lower interest rate all-round.

On the other hand, blue-chip stocks (i.e. big companies with good reputations) have a higher possibility of increasing value after purchase and paying out a dividend. They are riskier than T-bills as their prices are more volatile and might be down when you need to sell them. However, these large corporation stocks are likely to appreciate in the long run and tend to be correlated with the broader market.

At the extreme end, you have cryptocurrencies with the highest risk, most unknowns, and grey areas. It is sometimes unclear what drives crypto prices, especially altcoins (lesser-known coins), other than pure speculation.

On the downside, some of these riskier coins might result in a total downside, i.e. a crash to US$0.00, due to evaporating market demand, pump-and-dump schemes, or the founder absconding with the money.

DIFFERENCE BETWEEN SAVINGS AND INVESTMENTS. COMPLETED. ✅