Understanding Risk Appetite: Investor Types and Diversification Strategies

Risk is better controlled than avoided!

- Too many people are investing speculatively just to make quick money. You need to learn some fundamentals to better understand the objectives of investing.

- The first consideration of investing is to secure returns. You should know the end goals of your investments, plus whether they are suited to the time frame of your goals or not.

- The second consideration of investing is to manage risk. You should know what level of risk you can stomach and how much of it you should take on. How much risk you take on may depend on whether you are aiming to grow your existing assets or protect them from inflation, with both in the context of your investment timeframe.

Understanding Risk Appetite

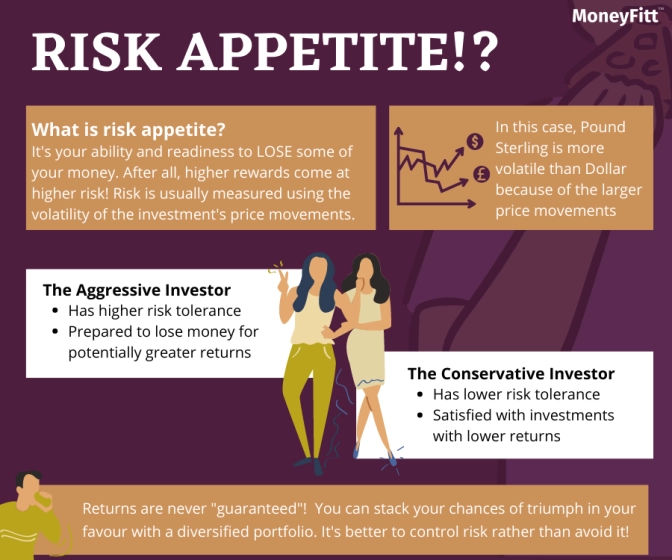

Understanding risk is key to a successful investment strategy. Risk appetite is your ability and readiness to lose some (hopefully not all) of your original investment for potentially greater returns. How much of a dip in the value of your investments are you prepared to see? In financial markets, risk is most often measured using volatility, or how much the price swings in either direction. IRL, we usually only worry about the downside!

Aggressive investors are prepared to lose money for potentially greater financial gains. On the other hand, conservative investors side with investments that maintain the value of their original investment. If you are unsure as to what your investment risk appetite is, we recommend taking a free online questionnaire to assess your risk tolerance or speaking to a professional financial advisor.

Regarding the level of risk you choose with investments, you can stack your chances of triumph in your favour with a diversified portfolio. No profits are ever guaranteed, so it is essential to control rather than avoid risk.

Diversification is an essential practice for both professional and non-professional investors, used to minimise the risk of financial loss without harming your potential returns.

The most common and practical way to achieve diversification yourself would be actively targeting a percentage of each asset class within your overall portfolio, as well as the number of investments within each asset class. At a high level, the thinking is that not all assets are likely to move in the same direction at once, meaning that a rise in one asset class's value offsets shorter-term losses in another, with the assumption that the right assets will all rise over the longer term.

Diversification is also important within asset classes. For example, not having 100% of your share portfolio in one share type, e.g. growth shares. Different segments of an asset class perform differently under certain economic circumstances, so diversifying protect your overall portfolio if one type of investment falls in value.

Grow Your Assets or Protect its Value?

Growing and adding to existing assets is a sensible consideration for those with time on their side. The younger you are, the likelier it is that you can afford to take on (a lot more) risk with your investments. Besides, younger people are more likely to have little value to protect anyway (sorry)!

As you creep towards retirement age, it is understandable to be anxious about investing, for fear of a market downturn or poor investments putting a dent in your retirement fund. If this is the case, then you should aim to protect your retirement fund’s existing value with a higher proportion of low-risk investments. One extremely rough rule of thumb is to:

- Hold a percentage of shares equal to 100 minus your age.

- Have the remaining balance in safe investments like investment grade or government bonds.

You may be thinking, well, why wouldn’t I just stick to cash in a savings account, as that’s safe? You’d be correct, as cash is the safest and simplest asset to understand. You know what you’re getting with cash returns as the interest you earn is easy to understand, plus you have almost zero risk of losing all your capital. Although cash is the easiest to understand, it does not usually provide strong returns over the long term compared to most other asset classes. The interest earned on deposits in a savings account rarely tops inflation, meaning your retirement savings would lose value in real terms.

What is Inflation?

Inflation is a rise in the general price level of goods and services in an economy. We haven't seen much high inflation in recent decades, but when it does appear, the effects can be devastating. Inflation is most commonly measured through the Consumer Price Index (CPI).

INVESTING CONSIDERATIONS - RISK. COMPLETED. ✅

Sources:

- https://www.sgx.com/research-education/market-updates/20181130-performance-highlights-spdrr-sti-etf-and-nikko-am-sti

- https://www.fool.com/investing/how-to-invest/index-funds/average-return/

- https://www.sgx.com/research-education/market-updates/20200102-sti-clocks-94-total-return-2019

- https://public.com/learn/how-to-set-investment-objectives

- https://www.oreilly.com/library/view/ft-guide-to/9781292129327/html/chapter-005.html

- https://www.ocbc.com/simplyspoton/financial-wellness-index.html

- https://www.investopedia.com/terms/b/buy-the-dips.asp#:~:text=%22Buy%20the%20dips%22%20is%20a,price%20in%20the%20short%2Dterm.&text=Therefore%2C%20they%20are%20buying%20when,some%20potential%20future%20price%20rise.

- https://www.fool.com/investing/how-to-invest/stocks/average-stock-market-return/

- Header photo by Pexels