Understanding Investment Considerations: Return and Risk

Smart investing begins with understanding Return and Risk

- Too many people are investing speculatively (cough, meme shares) just to make quick money. You need to learn some fundamentals to better understand investing.

- The first consideration of investing is to secure returns. You should know the end goals of your investments, plus whether they are suited to the time frame of your goals or not.

- The second consideration of investing is to manage risk. You should know what level of risk you can stomach and how much of it you should take on. How much risk you take on may depend on whether you are aiming to grow your existing assets or protect them from inflation, with both in the context of your investment timeframe.

In this article, we aim to help you better understand why you should invest.

Before Investing

Even before thinking of investing, there are 2 things you should consider:

First, you should set up an emergency fund and clear any debt that requires immediate attention, such as credit card on BNPL debt. Once you’re all set, go ahead and start investing as soon as you can. You mustn't wait until you think you are “rich" before you start on your investment journey!

Secondly, learn about financial goals before you start investing. If you are unaware of or do not have concrete goals, you’re likely to struggle to decide on what the best-suited investment objectives are for you.

The Two Investing Considerations: Return and Risk

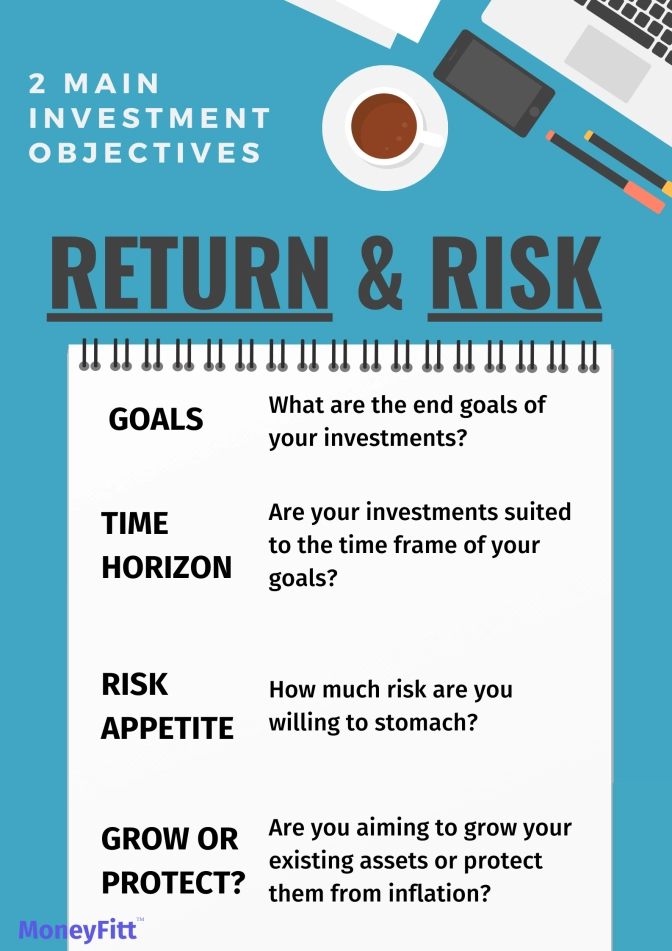

There are two main investing considerations every investor has:

Return

- Accomplishments: What are the end goals of your investments?

- Time horizons: Are your investments suited to the time frame of your goals?

Risk

- Risk appetite: How much risk (i.e. volatility, with a real chance of losing money) can you stomach? How much risk can and should you take on?

- Grow or protect: Are you aiming to grow your existing assets or protect them from inflation?

By chasing higher returns, you almost always need to take on more risk. This is known as the risk-reward trade-off.

Return: What Do You Want to Accomplish From Your Investments?

Usually, investments aim to grow your existing assets, but that growth should be aiming towards something. Example end goals for investments include:

- Funding a child’s university expenses

- Funding a wedding

- Funding your retirement

- Starting a small business

- Saving up for a home

- Supplementing (or replacing) your pay

Deciding what it is that you are aiming for will allow you to calculate the time frame of your investment.

Time Horizon

This is the period over which you invest. Investments should suit the time frame of your goals. When is it that you’ll want to access the money? For example, don’t try funding this year's Christmas vacation with an investment in $DOGE!

Ultimately, investing is a long-term game, so don’t let short-term volatility sway your mood on investing. Remember the saying - it's all about time in the market, not timing the market. It can be nearly impossible to know the best time to invest, other than in hindsight!

When looking at investing over a period, dollar-cost averaging is a sensible strategy.

Dollar-Cost Averaging

In Dollar-cost averaging, you split your purchase into separate periodic transactions. You will commit a fixed amount of money to invest in a particular asset on a regular schedule. This aims to benefit from price volatility when you buy and takes away the human element of trying to time the market (on top of the already difficult decision on what to buy)!

If you have short-term horizons, it’s quite likely that you’ll be relying on extreme levels of volatility (hopefully in your favour) to provide returns, as other forms of investment income, such as interest or dividend payments, will struggle to produce any sort of substantial quick returns.

What’s more, the stage of the economic cycle, or a company’s performance, is unlikely to drastically change in the short term. If you’re betting on volatility in your favour, remember that volatility goes both ways - just ask anybody who thought Bitcoin was quick easy money in November 2022, priced at $60,000… (Bitcoin went on to hit lows of $20,000 six months later). Savings Bonds/fixed deposits at a bank are sensible choices for those with immediate needs wishing to take on a low-risk and liquid investment.

Passive Income

It’s important to recognise the role that investments play in providing passive income, not just while people are of working age, but also as a form of income during retirement. Many people earn passive income through stock dividends, interest income and rental income. Right or wrong, many of those investors don’t care about the market prices of their investments at all, as long as they provide them with the income they want. Maybe they have a point!

Risk: Understanding Risk Appetite

Understanding risk is key to a successful investment strategy. Risk appetite is your ability and readiness to lose some (hopefully not all) of your original investment for potentially greater returns.

Aggressive investors are prepared to lose money for potentially greater financial gains. On the other hand, conservative investors side with investments that maintain the value of their original investment. If you are unsure as to what your investment risk appetite is, we recommend taking a free online questionnaire to assess your risk tolerance or speaking to a professional financial advisor.

Regarding the level of risk you choose with investments, you can stack your chances of triumph in your favour with a diversified portfolio. No profits are ever guaranteed, so it is essential to control rather than avoid risk.

Diversification is an essential practice for both professional and non-professional investors, used to minimise the risk of financial loss without harming your potential returns.

The most common and practical way to achieve diversification is to actively target a percentage of each asset class within your overall portfolio, as well as the number of investments within each asset class.

Grow Your Assets or Protect its Value?

Growing and adding to existing assets is a sensible objective for those with time on their side. The younger you are, the likelier it is that you can afford to take on (a lot more) risk with your investments. Besides, younger people are more likely to have little value to protect anyway (sorry)!

As you creep towards retirement age, you should aim to protect your retirement fund’s existing value with a higher proportion of low-risk investments. One extremely rough rule of thumb is to:

- Hold a percentage of shares equal to 100 minus your age

- Have the remaining balance in safe investments like investment grade or government bonds

You may be thinking, well, why wouldn’t I just stick to cash in a savings account, as that’s safe? Although cash is the easiest to understand, it does not usually provide strong returns over the long term compared to most other asset classes. The interest earned on deposits in a savings account rarely tops inflation, meaning your retirement savings would lose value in real terms.

What is Inflation?

Inflation is a rise in the general price level of goods and services in an economy. We haven't seen much high inflation in recent decades, but when it does appear, the effects can be devastating. Inflation is most commonly measured through the Consumer Price Index (CPI).

Investment Risk Pyramid

The investment risk pyramid highlights the different levels of risk associated with different asset classes. The risk pyramid is not a scientific model and is only a rough guide!

High-risk investments: investing in this section comes with a warning – be prepared to lose a big chunk or even all of it! High-risk investments should not take up too large a percentage of your portfolio, especially if you are a conservative investor or are approaching retirement age.

Medium-risk investments: investments here tend to produce consistent returns over the long run, but short-term volatility remains possible. It is expected that these investments will benefit from capital appreciation. You should consider these investments reasonably safe.

Low-risk investments: the base of the pyramid. The investments here offer the lowest risk for investors, but unfortunately are likely to also offer the lowest returns. These types of investments are likely to make up the largest part of a more "conservative" (risk-averse) portfolio, but need not make up too much of a younger or more aggressive investor's portfolio.

Ultimately, different people require different portfolios, so there is no set allocation you should follow based on this pyramid. However, the pyramid offers great use for helping identify which asset classes might be suitable for you, based on your risk-reward preference.

INVESTING CONSIDERATIONS. COMPLETED. ✅

Sources:

- https://www.fool.com/investing/how-to-invest/index-funds/average-return/

- https://public.com/learn/how-to-set-investment-objectives

- https://www.oreilly.com/library/view/ft-guide-to/9781292129327/html/chapter-005.html

- https://www.investopedia.com/terms/b/buy-the-dips.asp#:~:text=%22Buy%20the%20dips%22%20is%20a,price%20in%20the%20short%2Dterm.&text=Therefore%2C%20they%20are%20buying%20when,some%20potential%20future%20price%20rise.

- https://www.fool.com/investing/how-to-invest/stocks/average-stock-market-return/