Top 7 Tips for Money Management

The benefits of money management in Singapore are enormous. The task of effectively controlling your finances may seem daunting initially, but acquiring the right strategies and mentorship makes it achievable. In modern times, mastering effective money management can make a huge difference.

It’s common for people to be uncomfortable discussing finances. Emotions such as anxiety, fear and confusion can arise from it. Anxiety over finances can be brought on multiple reasons; it’s not always due to a lack of income. You may feel consistently stressed over your credit score, investment losses, insufficient insurance coverage, debt, or spending habits.

Why do we have so many emotions surrounding money? Surprisingly, money is not solely a group of numerical values and notes. Our values, beliefs, and experiences are also reflected by it.

How can we alter our feelings about finances and financial planning? Here are our 7 tips for successful money management.

1. Take Notice of Your Financial Narrative

What did you discover about finances while growing up? In what ways does this influence your present behaviours and feelings? When childhood is financially difficult, there may be nervousness about spending and saving money. Being brought up in affluence may make you view yourself as deserving of everything or apathetic toward other people’s needs.

2. Challenge your Money Scripts

Unconscious, underlying beliefs and assumptions may influence your financial decisions. Many people believe that money can buy happiness. These scripts may impede your potential and happiness. Endeavour to identify them and switch with more hopeful and feasible replacements. As an illustration, money serves as a tool for good and can purchase some joy.

3. Practice Gratitude and Generosity

Don’t focus on your wants or lack of possessions; instead, focus on appreciating what you have and can share with others. Scientific research indicates that exhibiting gratitude and generosity can promote well-being and reduce stress. Align your spending with your values and priorities. For example, donating to a cause you care about or treating a friend to lunch could be options.

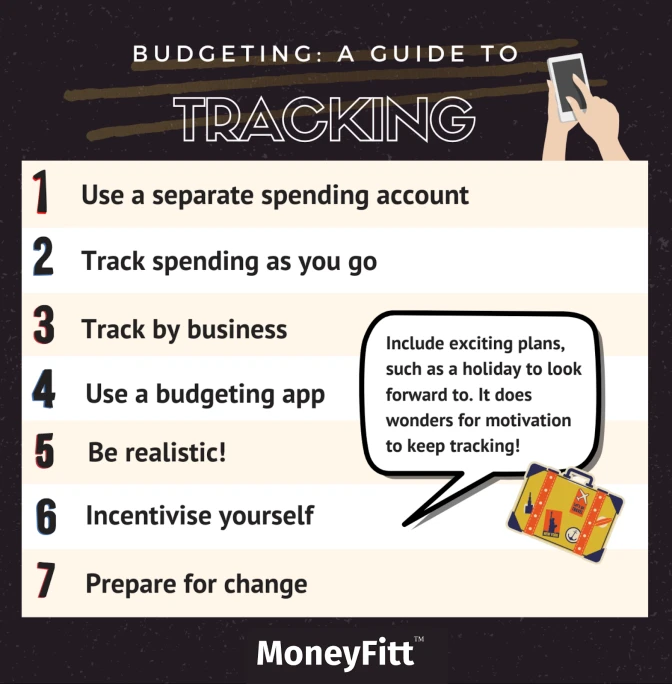

4. Have Fun with Budgeting

Yes, you read it accurately. Budgeting can feel enjoyable if you turn it into a game or challenge. Consider it a tool for enhancing your capabilities and reaching your targets instead of a restriction or penalty. Establishing a reward system is possible for staying within your budget. Another option is to challenge yourself to find innovative solutions for saving money or earning additional income.

It is possible to alter your emotions concerning money and budgeting with effort, although it won’t be easy. It may greatly affect your life. What are you delaying? Embark today and experience how much more delighted and prosperous you may be!

This blog post provides practical advice and relevant information if you need the tools to create a solid financial foundation.

5. Create and Stick to a Budget

Constructing and staying committed to a budget is vital in managing one’s money effectively to understand how much money is coming in versus going out. In addition to identifying what is important financially, creating an organised budget is necessary.

Acquire a practical budget by utilising our budgeting template. Furthermore, it aids in recognising your monthly expenses and monitoring your spending habits by sorting transactions into predetermined categories.

In other words, segregate essential expenses like rent or mortgage payments from discretionary spending like eating out and entertainment. Following that, appraise which sections could use some enhancement – perhaps reducing the amount spent on vacations can assist in increasing monthly savings.

Implementing spending limits for each category that accommodate current essential needs and potential future ambitions with enough flexibility allows room for making adjustments in the future.

6. Regularly Save Money

If you want effective financial management, saving money regularly is important.

Building up personal savings is necessary to ensure financial security and stability; it’s wise to begin with saving a small proportion of your monthly income—even if it’s only a modest amount, like 5 or 10%. As a goal, we recommend saving at least 20% of your monthly income and paying yourself first – which means putting aside savings immediately rather than at the end of the month with what’s left over.

You can simplify making regular savings by setting up automatic transfers from your checking account into a separate savings account without having to remember each month; this guarantees that you will consistently put aside money.

To save more efficiently, you should have defined financial goals in mind, such as an emergency fund or property savings, and the discipline of having specific objectives in mind for your finances can be a powerful motivator for regular saving and preventing frivolous expenses.

7. Avoid Taking Unnecessary Debt

Taking on debt is vital to managing finances and establishing credit, but avoiding unnecessary debt is crucial. Incurring unnecessary debt can result in significant future financial difficulties. Taking on debt only when there is a clear benefit is essential.

When contemplating acquiring debt, one must question the necessity of a loan or any other form of debt. Avoiding additional debt may be the most prudent choice when unnecessary. Can the purchase be executed without obtaining a loan? The long-term benefit to you or your family—should that be the case in reality—is the purchase essential?

Considering the expenses linked to obtaining a loan is crucial. The expense of borrowing money usually encompasses interest charges and other associated fees. Understand all the costs related to any loan before signing a contract. Additionally, it would be best to be mindful of possible dangers like missed payments or home repossession. Maintain financial well-being by preventing excessive borrowing by carefully evaluating each opportunity and ensuring the loan is within budget.

Practical Steps for Implementing the Tips

To implement the top tips for effective money management, tracking your income and expenses, setting financial goals, creating a savings plan, and prioritising debt payments are essential.

Tracking Income and Expenses

An essential element of proper money management is tracking all incoming and outgoing funds; these measures will help improve awareness of spending patterns and reveal possibilities for reducing expenses. Tracking your income and expenses can be made easy by following these practical steps:

Find out how much you earn monthly: This considers all fixed payment sources like a steady wage or additional work income.

Monthly expenses: Gather all your expenses for each month in one place by making a list that contains recurring expenditures, including rent & utility bill payments, along with uncertain spending, such as buying food or having fun. Alternatively, most banks have improved their features, so check the app your main bank offers.

Segment your outlays: Group resembling expenditures together to locate where you largely spend.

Use our budgeting template: It simplifies the process by helping you track your expenses and categorise the transactions into easily identifiable expense categories.

Track regularly: If you want to manage your finances better, allot some time each month to review how much you earn and spend.

Setting Financial Goals and Creating a Saving Plan

An efficient way of managing finances includes having a distinct set of monetary goals and a comprehensive savings scheme, so follow these actionable steps on how to do it.

Specify your economic ambitions: Start by questioning what you want to achieve and prioritising your top financial goals. Do you plan to save money for future expenses like buying your home or vehicle? Or would prioritising paying off debt and creating an emergency fund work better for you?

Determine a budget: Evaluate your present revenue and outlays to determine an all-encompassing budget, and apps like Planner Bee or Spendee can help you determine which areas of spending each month should be reduced.

Allocate funds: Set aside funds for key financial aims once you have prioritised and created an attainable budget plan, and saving a particular monthly amount towards an emergency fund or paying back loans might be required.

Automate savings: Automating your savings by setting up an automatic transfer from your salary account into a separate savings account each month can help you consistently save.

Review and adjust regularly: Consistently monitor and alter your financial goals, and consistently monitor how you’re progressing regarding financial goals to make alterations when necessary. This technique will prevent distractions and keep you headed toward achieving financial freedom.

Prioritising Debt Payments

One key element of effective financial management is making sure to prioritise paying off debts, and by implementing these helpful tips, it is possible to handle your debts with ease:

List all your debts: Note down any and every obligation that requires you to pay cash, such as credit card balances and home loans.

Choose one obligation at a time to pay off: Make an effort to pay down only one liability and simultaneously keep up with minimum monthly payments for other expenses instead of taking care of everything.

Consider debt consolidation: Managing debt can be daunting if you have multiple loans with high-interest rates, so consider making things easier by consolidating those loans into one payment at a lower rate.

Focusing on paying off high-interest loans before any other loans will ensure that you make significant strides toward becoming financially secure.

Good money management is one of the best ways to work towards your financial goals and stay out of debt. Singapore’s best money management courses are designed to help people get out of debt, manage their finances and improve their credit scores.