The 5 Factors to Consider When Getting a Credit Card

Find out if your lifestyle would benefit from having a credit card!

- Credit cards are a form of short-term borrowing that enables you to borrow up to the credit limit. The lender (usually a bank) sets a credit limit. Credit cards can be an easy way to get interest-free loans, valuable rewards, travel perks and shopping benefits. If used correctly, they can also help you build your credit score.

- But the costs far outweigh the benefits if you don't pay off your monthly balance. Any interest owed will quickly compound, and credit card companies usually charge very high interest in the first place!

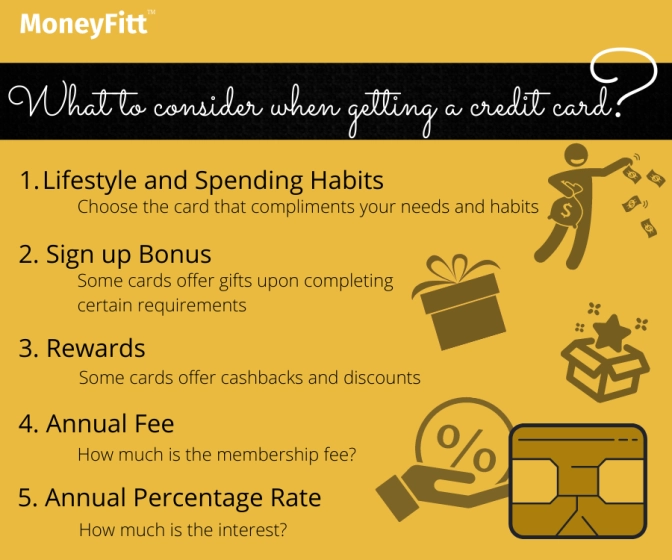

- The 5 factors include lifestyle and spending habits, sign-up bonuses, rewards, annual fees, and annual percentage rate (APR).

5 Factors to Consider When Getting a Credit Card

Lifestyle and Spending Habits

Are you a frequent traveller? Do you dine out often? Evaluating your lifestyle and understanding your spending habits will help you choose the right card to best complement your needs.

Sign-up Bonus

Many credit cards offer special bonuses when a new user meets a specific requirement. For instance, receive 85,000 air miles when you spend $4,000 in the first 3 months. Consider this: can you comfortably spend this amount in this time frame? If not, you won’t be getting any of the bonuses.

Rewards

Some credit cards offer fixed percentages towards their rewards program or higher percentages for specific categories and merchant partners (e.g. 14% cashback for petrol station transactions).

Annual Fee

There are credit cards that require an annual membership fee. Evaluate for yourself if it’s worth paying, considering that it probably comes with several perks you can maximise to offset the cost. It’s also good to note that you can contact your bank to have the annual fee waived. (So check your statements or include them on a recurrent date in your phone calendar!) Your bank will check your credit card usage and payment history before waiving the fee. So, make it a habit to always pay in full and on time.

Annual Percentage Rate

This is the interest rate on the outstanding balance. Some credit cards offer low promotional APRs initially, which then eventually rise after you’ve had the card for a year or more. Thankfully, you won’t have to worry about APRs if you’re punctual in fully paying your credit card every single month.

Before applying for a credit card, you should first consider whether you’ll be able to use it responsibly. Will you only charge what you can afford, so you can pay the balance on time and in full each month? So if you can utilise credit cards responsibly, they’re powerful financial tools that can serve you for years.

FACTORS TO CONSIDER WHEN GETTING A CREDIT CARD. COMPLETED ✅.

Sources:

- https://www.investopedia.com/articles/pf/10/credit-card-debit-card.asp

- https://learn.moneysmart.sg/credit-cards/credit-card-basics/how-do-credit-cards-work/

- https://www.moneysense.gov.sg/articles/2018/10/understanding-credit-cards

- https://www.creditcardinsider.com/blog/how-does-a-credit-card-work/#are-credit-cards-a-good-idea

- https://www.moneysmart.sg/credit-cards/credit-card-bank-application-basics-ms

- https://www.singsaver.com.sg/blog/what-happens-when-you-cant-pay-your-credit-card

- https://gendal.me/2014/08/09/