Robo Advisors: A Simplified Approach to Investing | Pros and Cons

A great beginner-friendly tool to automate some of the investment grind

- Robo advisors are digital services that manage your investment portfolio for you.

- There is a wide range of robo advisors and portfolios for experienced and beginner investors.

- Each robo advisor may have different annual fees for various portfolio types, so do keep a lookout.

If you’re just getting started building your portfolio or an experienced trader who wants to offset some of your load, robo advisors are something you can consider! Robo advisors can simplify the process of investing. They make the “complex” simpler.

What are Robo Advisors?

Robo advisors are digital platform services that combine portfolio management with automated algorithms and investment solutions. Their focus is to help clients efficiently handle and invest their money in the ever-changing and complicated world of finance.

Robo advisors will typically gauge your risk appetite and investment objectives through a questionnaire which will help them evaluate what type of portfolio would most suit your needs. They will then store your money and invest it in various ETFs, unit trusts, and individual shares and bonds, making adjustments as time goes on. However, each robo advisor may only invest in a select range of financial products.

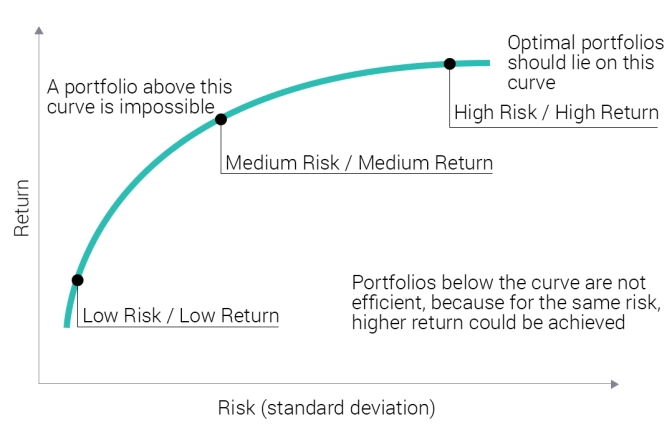

Most robo advisors were founded on Nobel Prize winner Harry Markowitz’s Modern Portfolio Theory, which explains creating diversified investment portfolios with the greatest returns for each risk level. So most of your available options all have the same theoretical underpinnings!

Markowitz’s Modern Portfolio Theory (MPT)

The MPT aims to maximise the expected return of a portfolio for a given level of risk or to minimise the level of risk for a needed amount of return. There are two types of risk: inherent risk (which is unique to a particular investment) and market risk (which affects all the investments in the market). MPT uses a mathematical form of diversification to eliminate inherent risk as much as possible. The mathematical model determines the weightage of your individual assets in the portfolio.

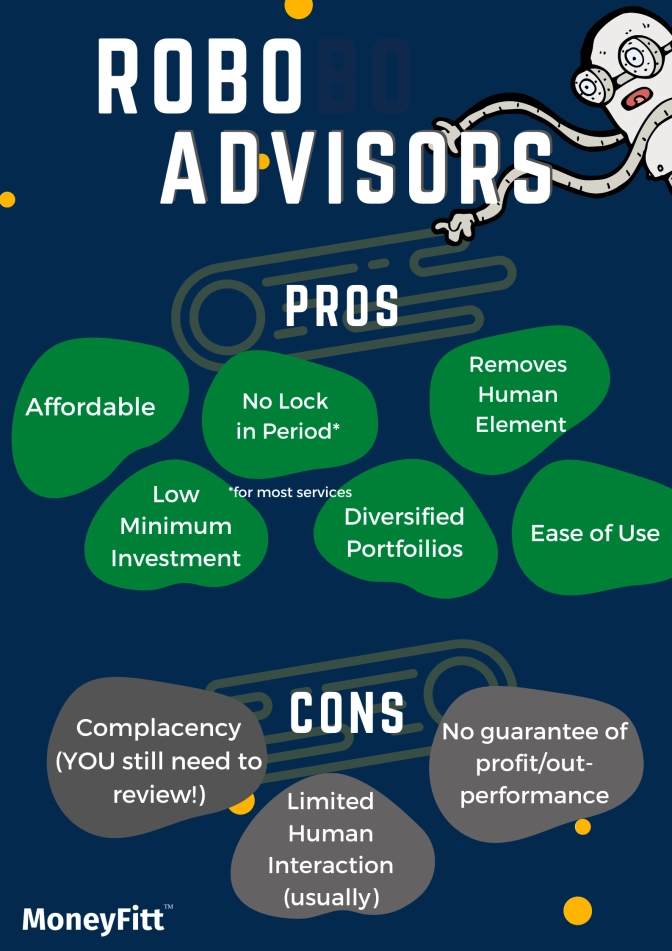

Pros of Robo Advisors

Affordable

Robo advisors generally have low fees than hiring a human financial advisor.

For robo advisors, you can expect to pay 1% or less of yearly advisory fees, whereas you may be paying around 2-3% for financial advisors (and even more for highly sought-after ones!). These advisory fees can eat into your long-run returns as they’re charged yearly, so it’s best to weigh out the cost against the value you’ll get from either robo advisors or financial advisors when making a decision.

Low Minimum Investments

You don’t need a lot of money to open a robo advisor account. Typically, you can expect the minimum investment amount to be around $1,000, though that may differ between countries.

Ease of Use

The whole point of robo advisors is to make investing simple; not only through simplifying the portfolio building process but also through their digital interfaces. Most robo advisors that you’ll see have web and mobile versions of their digital platforms, with customer service and FAQs readily available.

Removes Human Element

Robo advisors use cutting edge algorithms and models to design a portfolio that maximises expected returns and minimises risk. Unlike human analysis, robo advisors are not affected by emotion and make logical decisions backed by data and statistical evidence.

Diversified Portfolios

When building your portfolio, robo advisors always keep diversification in mind (or “in CPU”). As robo advisors generally have access to a range of funds, ETFs, and other financial instruments, they can easily diversify your portfolio. So, you don’t need to worry about putting all your eggs in one basket!

No Lock-in Periods

Most robo advisors do not have lock-in periods. This means that you can withdraw your money at any time, without penalty. If the robo advisor simply isn’t working for you, just get out! It’s always good to have an exit strategy.

Cons of Robo Advisors

Complacency

Robo advisors can help you build a diversified passive portfolio, but it doesn’t mean that you should be complacent! Robo advisors do not have access to your entire financial circumstance, only the basic information required to fit you into a particular box. Their offerings are based on which box you fit into best. It’s not a true “personal” recommendation; after all, robo advisors were designed for the masses. So you still need to keep an eye on your investments.

Limited Human Interaction

Sometimes, having a human there is much more efficient and effective. Instead of combing the FAQ site for an answer, hoping that a chatbot understands what you need, or waiting for customer service to get through a queue of callers, getting a response from your financial advisor with decades of experience may take much less time.

Also, a financial advisor can add a dash of a human touch, which can be much-needed when settling your portfolio and even more so if something happens to go wrong.

New (And Overreliant On) Technology

Robo advisors are a relatively new technology. How effective they are remains to be seen. What's more, in the face of rising cyber threats, the heavy reliance on technology in robo-advisory services poses a significant risk. Despite robust security measures, no system is entirely immune to breaches or glitches, potentially affecting investors' access to accounts and transaction execution.

Choosing a Robo Advisor

Let’s take a look at some factors to keep in mind.

Fees and Minimum Investment

Different robo advisors have different yearly advisory fees and minimum investment required. Within each robo advisor, different types of portfolios may also have varying advisory fees and minimum investments required. Furthermore, investing a higher amount within each type of portfolio may lead to a lower yearly advisory fee. It’s essential to get a holistic view of the fees when comparing robo advisors, as the fees can eat into your long-run returns.

Investment Selection

Each robo advisor may be more inclined to invest in a certain type of financial instrument. For example, some may focus on investing in funds, while others mainly focus on ETFs.

Interface

Of course, we all want the easiest and most convenient way to invest our money. The digital platforms that these robo advisors boast are as crucial as their offerings. You should look for one that is both understandable and easy to navigate.

Conclusion

There’s a lot to consider before choosing which robo advisor to engage with (if you even are going to engage one), so take your time to compare them using the above factors! Don’t be too stressed about it, though, since robo advisors are meant to take away most of the stress of investing. Since most robo advisors do not have a lock-in period, you can always pull out of a robo advisor if it feels unsuitable. What matters is that you do what is best for you and your money!

ROBO ADVISORS. COMPLETED. ✅

Sources:

- https://dollarsandsense.sg/robo-advisors-in-singapore-what-you-need-to-know-before-investing/#:~:text=Advisor%20For%20Yourself-,What%20Is%20A%20Robo%20Advisor%3F,invest%20and%20manage%20our%20money.

- https://www.ft.com/content/e609f0ee-7acd-446d-9206-fe0bfb49b4d8

- https://www.nerdwallet.com/article/investing/what-is-a-robo-advisor

- https://www.investopedia.com/articles/financial-advisors/032415/how-evaluate-roboadvisor-schw.asp#:~:text=Factors%20to%20consider%20are%20the,arena%20is%20a%20further%20consideration.

- https://endowus.com/insights/4-points-to-consider-when-choosing-a-digital-wealth-platform-roboadvisor/

- https://blog.seedly.sg/robo-advisor-financial-advisor/

- https://www.moneycrashers.com/pros-cons-investing-robo-advisors/

- https://tokenist.com/investing/robo-advisors-are-they-actually-profitable/