Money Hack: Learn How to Save Your Raise and Retire Early

Never have to decide between YOLO or F.I.R.E again

- The ‘save half your raise’ strategy considers your retirement sum and the impact of saving habits on spending habits.

- Saving half your raise means you're only spending half of your raise - which allows you to have a more controlled increase in your standard of living, resulting in a lower retirement sum needed (pushing back against something called "lifestyle creep").

- Following the ‘save half your raise’ strategy will give you the option to quit the rat race and retire at a significantly lower age, should you wish to do so.

Pay raises, or "increments", are the fruits of our labour. Receiving one can instantly spark thoughts about what the money should go on to do. Often, we view the raise as ‘spare’ money in our budget and allocate it towards improvements in our lifestyle – such as allowing our grocery shopping to become more expensive, purchasing that shiny new car you’ve been eyeing, joining that expensive gym or golf club you’ve always fancied etc.

However, what if we were to tell you that by allocating all of your raise towards lifestyle upgrades, you’re pushing back the day you can retire. After all, upgrading your lifestyle will put a dent in your bank account. What we’re describing is known as lifestyle ‘creep’.

In short:

Increased income = increased sense of entitlement = upgraded lifestyle = larger retirement lifestyle required

If your salary goes up from $50,000 to $60,000 and you maintain a saving rate of 10% of your income, then the amount you save, in absolute terms, would increase from $5,000 to $6,000. The issue with this is that it doesn’t account for "lifestyle creep".

Mo’ Money, Mo’ Problems… ?

Our budgeting basics article touched upon the idea that you could avoid lifestyle creep and retire earlier if you save your raise or even half your raise. In this article, we’re here to delve further into the topic.

What is Save Your Raise?

This simple strategy is exactly what it sounds like - saving up any bonuses or raises you get. However, we know that saving the entirety of your raise may be daunting, so alternatively, you can also save half your raise.

We recommend the latter. By spending half of your raise and putting the other half towards retirement, you are gradually increasing your standard of living whilst also committing to accelerating the growth of your long-term savings and the option of early retirement.

And as for those who are currently not great at saving, holding back from spending a single cent of a well-deserved bonus can be extremely difficult. As such, permitting yourself to spend half of every future raise, it becomes easier to make the long-term saving commitment of saving half of every future raise.

Practising saving this way could encourage those who are currently poor at saving to become effective savers. But being poor at saving does not necessarily mean financial irresponsibility. Many people cannot save because they are struggling to make ends meet as it is, for reasons such as the cost of living or commitments out of their control.

Example

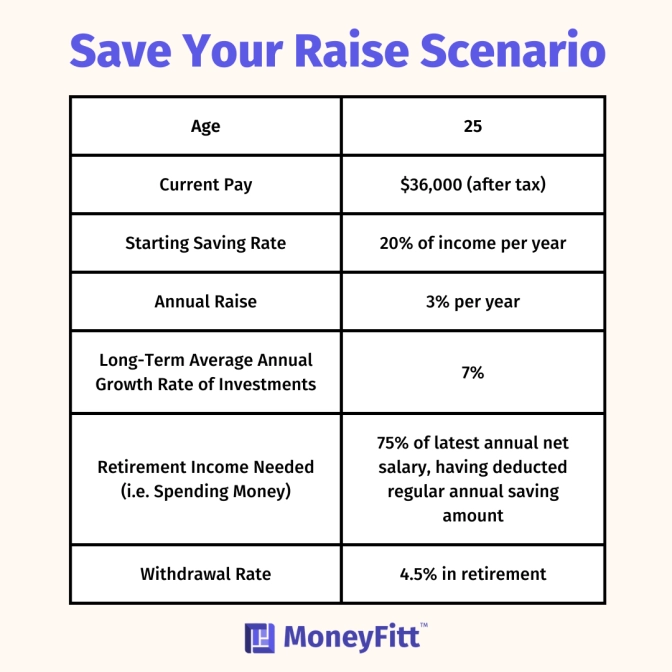

So, let’s demonstrate just how advantageous it can be to spend (and save)! half of your raises, using two individuals where the below is applicable to both:

Why a 4.5% Withdrawal Rate?

- The 4.5% Rule is a recent update to the traditional 4% Rule by its founder, Bill Bengen

- Initially, the 4% rule was an easy-to-follow rule used by numerous financial planners. Following the rule provided stable, predictable income during retirement - but sticking to just 4% has become outdated.

- The original 4% rule suggested a 50:50 balance between common shares and immediate-term Treasury bonds in your portfolio. Nowadays, the 4.5% withdrawal rate rule suggests an allocation of 30% large-cap shares, 20% small-cap shares and 50% immediate-term Treasury bonds.

Person A

- Saves 20% of annual income

- Can retire at 58 years old

Person B

- Starting at the same % of income

- Spends (and saves) 50% of all raises

- Can retire at 49 years old

- Can retire 9 years earlier than the conventional saver

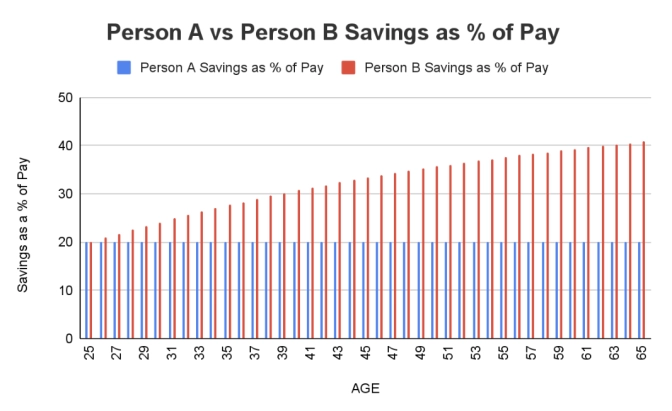

The Savings as a Percentage of Pay

By saving half her raise, Person B saved a much higher percentage of her pay than Person A, who never made it above 20%. After just ten years of saving, Person B was already saving at a rate of 28% of their annual pay.

By the time of Person B’s retirement age (49), she saved 35% of her annual pay. A staggering difference between the two!

Compound Interest

We always like to stress the importance of getting compound interest to work for you from a young age. It's never too late to start, but the earlier, the better! Saving half your raise is a way to turbocharge that effect!

Compound interest seriously boosts your savings. By reinvesting the interest you’ve earned, your savings can build momentum by earning interest on the interest you're earning. Free money! (Of course, this applies, with more volatility and historically higher long-term returns, to investing in markets, not just to earning interest on your deposits.)

The Bottom Line

Person B enjoyed a regular increase in her living standards and simultaneously achieved her target retirement sum 9 years before Person A.

This achievement did not take much. All it took was a commitment to enjoy spending half their raise and save the rest. By taking up this commitment as young as possible, you can enjoy the most benefit from compound interest (and time in the market at an age when you can stomach higher volatility in returns). If you currently struggle to save half of your raise, at least aim not to spend it all. Keep the mindset that limiting spending now lowers the amount of saving required in the years to come. Commit to spending half or less of all your future raises today!

BUDGETING - SAVING HALF YOUR RAISE. COMPLETED. ✅