How to Manage Both Financial and Mental Well-being

Getting stressed over finances? You're not the only one

- Financial well-being is one of the largest contributors to stress. A 2023 PwC study revealed that 57% of employees said that finance caused them the most stress in their lives. This figure was nearly double the combined number of employees who said their top concern was their job, relationship or health!

- Bad financial habits can create a nasty feedback loop between financial well-being and mental health.

- Establishing your financial goals, tracking your spending, budgeting correctly, paying your bills on time, and boosting your financial literacy are all vital ways to help you kickstart your journey towards having control of your finances!

In recent years, well-being has become an increasingly important priority both at home and in the workplace. There are many dedicated products, classes and blogs to improve well-being flooding the market. Yet the emphasis has been split – while areas such as mental, emotional and physical well-being are often cast in the spotlight, their equally important yet often overlooked cousin, financial well-being, has rarely made headlines.

What Is Financial Well-Being?

Put simply, financial well-being measures how you view and manage your finances. It can be broken down into four areas: control over finances, financial freedom to choose to enjoy life, capacity to absorb financial shocks and progress towards financial goals.

What Is the Link Between Financial Well-Being and Mental Health?

Well, research shows that poor financial well-being is one of the largest contributors to stress. A survey conducted by PwC in 2023 revealed that 57% of employees said that finance caused them the most worries. Considering how much emphasis we place on making money, this is hardly a surprising conclusion.

It’s especially hard to think about much else if affording necessities is a struggle, or if the debt is lurking in the background. Even if you have enough money to sustain yourself, you may be unhappy with your current lifestyle if you have high-interest debt or feel that your current cash flow is restricting your life. As such, it’s easy to see how stress and unhappiness stemming from financial worries can start to impact one’s mental health.

A Nasty Feedback Loop: Financial Well-Being and Mental Health

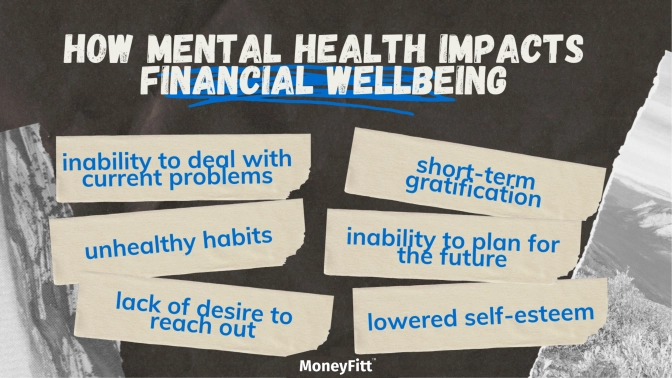

Many of us can easily feel the implications of poor financial well-being on mental health — but the reverse is true too! You will likely make bad financial decisions if your mental health is not the best. And if you’re making bad financial decisions, this will further pull your financial well-being down, impacting your mental health, which will….you get the gist. It’s a vicious downward spiral, and once you get caught in the cycle, it’s hard to get out.

To understand this better, let’s take a closer look at how poor mental health leads to bad financial decisions:

Inability to Deal With Current Problems

Stress can sometimes feel like a heavy weight on your shoulders, preventing you from getting up and facing your problems. Instead, you may find yourself watching that stack of bills on your counter grow, continuously putting off calling your bank or service provider, or any other task that seems like a burden. Without action taken, your financial problems rack up, adding to your burdens.

Lowered Self-Esteem

A common outcome of poor mental health is lowered self-esteem. This often arises when you compare your lifestyle to that of your peers and feel the need to be “equal” to them. This may mean you start buying goods or, even worse, leading a lifestyle you cannot afford, often leading to hefty overdrafts and other high-interest forms of debt.

Short Term Gratification

Anxiety may lead to a state of restlessness, in which you feel certain actions will help alleviate that feeling. Some people turn to emotional eating, going on social media or watching videos instead. Shopping is one such comfort, and although it may give you that burst of endorphins you need, the splurges will lead to worse financial well-being.

Unhealthy Habits

A lot of people resort to unhealthy habits such as gambling or alcohol in an attempt to forget their worries. However, these habits are usually costly. Often, drinking alcohol and smoking cigarettes are relatively expensive habits, and depending on them may result in huge chunks of savings getting thrown away. Debt in gambling, especially, is a huge burden to bear.

Lack of Desire to Reach Out to Others

While your friends and family may be no experts on finance, reaching out and sharing your problems with your support group is a great way to help unload your burdens. Unfortunately, when you’re down in the dumps, you may find it difficult to reach out to others. Isolation puts you at risk of loneliness, anxiety and even physical ailments like heart disease.

Inability to Plan for the Future

Planning ahead is so important to help you set your goals and budgets. If you’re feeling anxious or stressed, sitting down to carefully think and plan out your future is probably the last thing on your mind.

5 Tips to Improve Your Financial Well-Being (And Mental Health)

The easiest way to prevent yourself from getting stuck in this cycle is to prevent yourself from entering it in the first place. We have five tips to help prevent you from entering the cycle!

As with any other aspect of well-being, you must put in the effort to ensure your financial well-being is good. Below are 5 easy tips to get you started:

1. Plan for the Future

Planning for your future may seem like a big, daunting task, but you’d be wrong to assume that you either need a tonne of financial knowledge or a financial advisor. Planning doesn’t have to involve complicated investments or calculations. You can start by realising your financial goals. List your financial goals, categorise them into short-, medium- and long-term goals, rank them in terms of priority, and create separate bank accounts for them.

2. Track Your Spending

Be mindful of when and how much upcoming bills are, plus how much of your take-home pay remains, before making purchases – something a quick glance at your bank balance will not do! This proactive approach to budgeting reduces the risk of unexpectedly having to take on any new debt, and by being more aware of your outgoings, you may start to question the ‘need’ for some of them.

3. Budget Correctly

Budgeting is probably the way to go unless you’re the sole heir to a multinational conglomerate. Many people will follow the 50-30-20 rule regarding budgeting. This rule involves dividing your after-tax income into three categories: essential needs (50%), discretionary spending (30%) and savings and investments (20%). We recommend that you add to this the ‘pay yourself first’ rule, where the emphasis gets put on the importance of doing the 20% part first. This method prioritises long-term savings goals, such as retirement, rather than the usual expenses such as rent and utility bills. In addition, by saving first, you will automatically have fewer funds available for the remainder of the month, meaning you are likely to spend more sensibly.

4. Pay Your Bills on Time

Blindingly obvious, but not always followed. Pay your bills on time. It’s as simple as that. Late fees often incur extra charges and can affect your credit score later in life.

5. Improve Your Financial Literacy

Given how important it is, it is shocking that financial literacy is not taught in most schools, but it’s never too late to start learning. Our content library is designed to help you learn and understand finance better, no matter what stage of life you’re currently in.

Attaining financial well-being can be stressful — but the good news is it doesn’t have to be. You can be in control of your finances - and recognising the importance of financial well-being is simply the first step on the journey. It’s great that you’re here now, learning about finances and taking charge of your journey!

FINANCIAL WELL-BEING AND MENTAL HEALTH. COMPLETED. ✅

Sources:

- CFPB (2015), “Financial wellbeing: What it means and how to help,” https://files.consumerfinance.gov/f/201501_cfpb_digest_financial-well-being.pdf

- PwC (2016), “Employee Financial Wellness Survey,” https://www.pwc.com/us/en/private-company-services/publications/assets/pwc-2016-employee-wellness-survey.pdf

- https://www.verywellmind.com/the-benefits-of-being-by-yourself-4769939#:~:text=Being%20alone%2C%20on%20the%20other,pressure%2C%20and%20even%20early%20death.