CPF Investment Scheme (CPFIS): A Guide to Investing Your CPF Savings

CPF doesn’t need to be passive!

- You can voluntarily take part in the CPFIS and SRS schemes.

- CPFIS allows you to invest your CPF savings into approved financial instruments instead of earning the fixed interest rate assigned to the various CPF accounts.

- The SRS is not part of the CPF but a scheme by the IRAS to encourage individuals to save for retirement, over and above their CPF savings, with contributions eligible for tax relief.

Investing Under CPFIS

If you’re looking for higher interest rates for your CPF savings, you can always transfer funds from your Ordinary Account to your Special Account, which increases the returns from 2.5% per annum to 4% per annum. However, you will no longer be able to use these sums for some insurance, education, investments and housing. The move will also be irreversible.

Instead, you may consider using the CPF Investment Scheme (CPFIS) to maximise your CPF balance. CPFIS allows you to invest your Ordinary Account and Special Account savings in numerous instruments such as unit trusts, bonds and shares, and insurance products. As the CPF itself is designed to be built up over your career for your retirement, investing your balances now is an excellent way to potentially boost the growth of those funds significantly over the long term.

It should be noted that, as with all investments, future gains are not guaranteed, and it is possible in some cases, you may have been better off leaving your money in the OA and SA accounts and not using the CPFIS at all. Consider whether you need to engage with a financial advisor before investing.

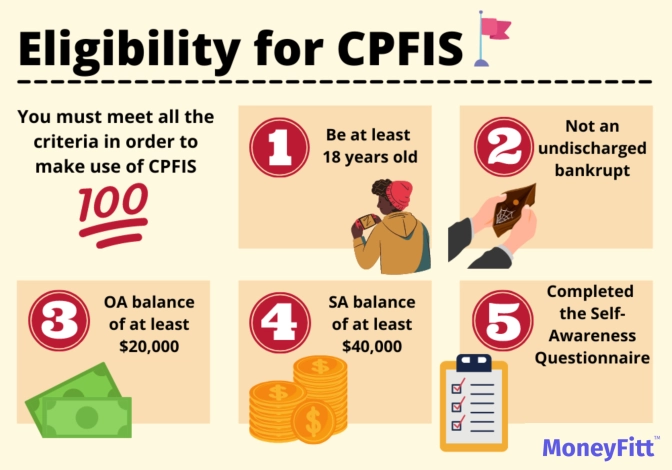

As shown above, the minimum requirements for CPFIS are as follows:

- Must be 18 years old

- Not undischarged bankrupt

- CPF Ordinary Account balance of $20,000

- CPF Savings Account of $40,000

- Before you open a CPFIS, you must take a Self-Awareness Questionnaire (SAQ)

The reason for having a different Ordinary and Special Account minimum balance is that there are two CPFIS schemes, one for OA and another for SA. The CPFIS-OA provides more investment products to choose from compared to CPFIS-SA. The table below summarises the options available:

Additional Information on Investment Products

ETFs

Choose between five CPF-approved SGX-listed ETFs:

- SPDR Straits Times Index ETF

- Nikko AM Singapore STI ETF

- Nikko AM-StraitsTrading Asia Ex Japan REIT ETF

- ABF Singapore Bond Index Fund

- SPDR Gold Shares

- Nikko AM SGD IG Corporate Bond ETF

Also, you can only invest up to 10% of your total investible savings in Gold ETFs. This is a form of mandatory diversification!

Shares

Must be SGX shares and can only take up to 35% of investible savings from OA. Find eligible shares here.

Fixed Deposits

Four CPF-approved providers:

- DBS Bank Ltd

- United Overseas Bank Ltd

- Oversea-Chinese Banking Corporation Ltd

- Maybank Singapore Limited

Bonds

All Singapore Government Bonds, plus treasury bills, are included. However, Singapore Savings Bonds are not.

When calculating your estimated returns, remember to factor in the investment costs. These will vary from product to product. For example, ETFs typically carry lower fees than unit trusts. Investments must suit your goals' time frame and acceptable risk level. Investing is vitally important. Educate yourself, do your due diligence and do not get involved with investments you do not understand.

How to Invest Under CPFIS

We suggest investing with CPFIS-OA before CPFIS-SA, as it is easier to achieve returns above a 2.5% interest rate than a 4% interest rate. First, you should:

- Open a CPF Investment Account with a Singapore bank to allow the bank to oversee the funds.

- Open an account with a certified CPFIS investment brokerage to facilitate the investment of money.

- Alternatively, if you do not wish to choose your investments, you could go through the robo advisory firm Endowus.

Voluntary Contributions Using SRS

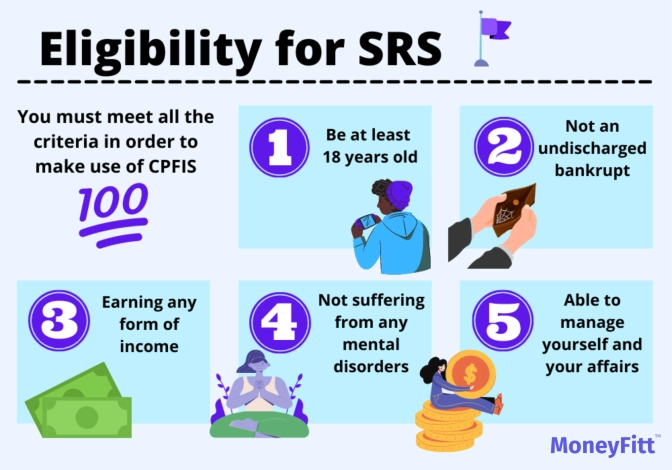

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage Singaporeans to save for retirement, above and beyond their CPF savings.

Opening an Account

There are three SRS operators:

- DBS Group Holdings Ltd

- OCBC Ltd

- United Overseas Bank Ltd

To establish an SRS account, locals need only to present their identity cards or passports. As for foreigners, you will need proof of identity and a completed declaration form for SRS.

Contributions

You can contribute as many times as you like; however, the annual maximum contributable amount is currently $15,300 for Singaporeans and PRs, or $35,700 for Foreigners. Contributions can only be made in cash and are eligible for tax relief.

Tax Relief

By making SRS contributions, you are increasing your personal reliefs total, reducing your taxable income. Here’s how it works:

Tax Benefits

Generally, the higher your taxable income, the greater your tax savings are when you contribute to your SRS. Although you are making significant tax savings when contributing to your SRS, you are not escaping payment of the tax altogether, as your SRS withdrawals become taxable once you reach 63 years old. However, only 50% of those withdrawals are taxable (compared to 100% taxable + 5% penalty on withdrawals before 63), meaning it still does provide a desirable tax saving.

Another plus is that you are likely to be in a lower tax bracket at or after 63, as income earned from employment is usually lower. For example, if you withdrew $35,000 PA, $17,500 (50%) would be taxable. However, Singaporeans do not pay income tax on the first $20,000 they earn, meaning the withdrawal would be tax-free!

It is also far more tax efficient to do this level of withdrawal, say 15 years in a row, than withdraw $525,000 in one lump sum, as 50% of the lump sum would become taxable.

Investing Your SRS

Investing is a great way to grow your SRS potentially. Your SRS has a 0.05% fixed interest rate, which is minimal, so consider investing in one or more of the wide range of different investment products available, such as Bonds, Singapore Government Securities (SGS)/Singapore Savings Bonds (SSB), Fixed Deposit, Foreign Currency Fixed Deposit, Shares, Single-Premium Insurance, Unit Trusts.

CPF VOLUNTARY SCHEMES. COMPLETED. ✅

Sources