Core-Satellite Investing Strategy: Above-Average Returns with Below-Average Risk

Your whole life doesn’t need to revolve around your investment portfolio!

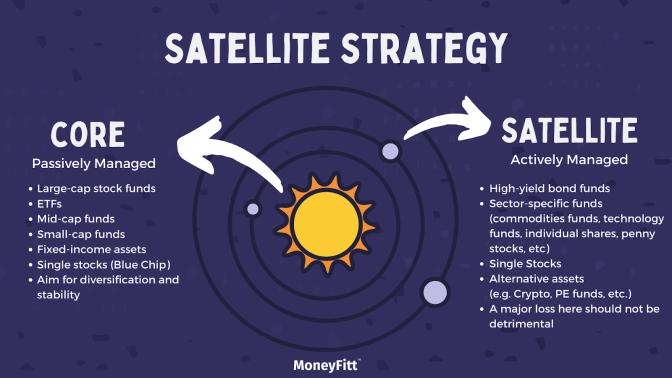

- The core-satellite investment portfolio consists of a passively managed “sore” and an actively managed “satellite”

- The “core” should contain diversified large-cap funds and ETFs to act as your stable foundation

- The “satellites” can be a collection of higher-risk assets that you think will outperform the market

We all know that higher rewards never come without higher risk. That said, we can always try to mitigate some of these risks and protect ourselves in multiple ways. A core-satellite strategy aims to achieve returns that are above-average while maintaining a risk level that is below-average. Sounds too good to be true? Read on to find out more.

What Is the Core-Satellite Investment Strategy?

This portfolio strategy consists of “core” and “satellite” portions. The “core” portion is the largest part of the portfolio, taking up about 60% to 80% of the portfolio weight. This portion gets invested in diversified assets such as unit trusts and index funds that give you exposure to the entire market. Your positions are basically just left alone, other than periodic rebalancing, i.e. buy-and-hold positions, to ensure that a significant part of your portfolio will be more or less in line with the market over the long term.

So how do you get above-average returns? Well, with that remaining 20% to 40% of your portfolio, of course! This portion is your “satellite”, a more actively managed part of your portfolio where you aim to beat the market. Higher-risk financial instruments will fall under this portion. The idea is that none of your higher-risk investments in your “satellites” will be significant enough to your portfolio that a major loss would derail your long-term investment objectives and ruin your life, basically.

The “Core”

Your “core” portion of the portfolio needs to focus on diversification and stability. Usually, the recommendation is that investors hold a range of diverse large-cap stock funds and ETFs (consisting of companies with high market capitalisations). This ensures that your investments are in companies that are currently leading the market. If the market does well, so will your “core”!

Large-cap Equities

Large-cap companies tend to survive through economic downturns and tend to have relatively stable share prices that rise over time. Of course, this is not always the case, but there is a high likelihood that their successful-to-this-day structure will help them outlast other competitors when the going gets tough. In the long term, they provide stability and consistency.

Here are some broad-based ETFs that focus on large-cap companies that you may consider (we are not providing any recommendations, so please do your own due diligence or seek professional advice):

- SPDR S&P 500 (SPY): this fund invests in the 500 companies with the largest market capitalisation in the US

- Vanguard Total World Stock ETF (VT): this fund contains over 7,000 shares across the world

- Vanguard REIT ETF (VNQ): this fund contains companies that invest in real estate properties

- iShares MSCI Emerging Markets (EEM): this fund invests in over 800 companies across 15 of the fastest-growing countries in the world

You should also ensure that your “core” investments are thoroughly diversified. After all, diversification is for protection and stability, and that’s the essence of your “core”! So while your focus should be on large-cap funds and ETFs, you could also buy mid-and small-cap funds, plus fixed-income assets. You can also add a few high-quality blue-chip shares to your core portfolio (local and international companies). Remember to check the fund's Total Expense Ratio, the lower, the better (and only pick ones with a TER of below 1% p.a.) Some ETF expense ratios can be surprisingly high.

Other Suggestions to Fill Your “Core”

Leveraged Endowment Plans and Other Investment Linked Policies (ILPs)

Endowment plans and other ILPs offered by insurance companies are alternatives to consider. For example, an endowment plan can come in many shapes, sizes and names. These could involve either a single or regular premium over a fixed period. At the maturity date, you receive a lump sum payout with a guaranteed and non-guaranteed component. Death Benefits (we don't love the term either) are typically attached, so part of your premium gets used for coverage, with the rest going towards the investments for your final lump sum payout. As these are not meant to be very aggressive investments, returns are usually quite modest (with low volatility).

To enhance returns, single premium endowment plans are often offered with leverage, i.e. borrowing money from a bank to increase the policy size and hence the lump sum received at the end (and the Death Benefit if your end comes before the policy's). You will be regularly paying interest on the loan throughout, but even net of that, the higher invested amount is intended to make it a better return investment over the period of the plan. However, there are risks. Mainly, the interest rate is floating, so the loan taken out could cost you more, besides the fact that the investment returns are not guaranteed. As with all funds, check the Total Expense Ratio and any potential sales charges that could be added on.

Robo Advisors

You can also consider opening a robo advisor account to handle the “core” of your portfolio. Robo advisors use algorithms and mathematical models to ensure that your investments in the account are diversified. Although, if you go down this route, ensure that you also note what your robo advisor account holds! Just because your “core” investments are managed for you doesn’t mean that you should ignore them.

The “Satellite”

The “satellite” investments are where most investors’ core-satellite portfolios will vary. You’re chasing higher returns here, so this is where you can invest in anything you want, according to your risk appetite. You can consider high-yield bond funds, country or sector-specific funds such as commodities funds and technology funds, individual shares, penny shares, etc. Do your research and assess which market or company you think could do well in the short-term or long-term.

Remember that while the “core” is more or less left alone, the “satellite” should be more actively managed. You need to stay on your toes and assess the market situation to get higher returns. This is especially so if you’re going to be trading individual financial assets, though we would suggest caution if you are planning to do so. If you’re not the investor with the time or inclination to do so, you can consider selecting targeted ETFs or actively managed funds for your “satellite”. Just because it is in the "actively managed" satellite part of your portfolio does not mean you have to trade constantly, tempting as that may be to some!

Main Benefits

1. Lower Volatility

With a large portion of your portfolio being heavily diversified, your volatility will be pretty low. This means that your overall portfolio value will be relatively stable and will not likely fluctuate greatly if one market takes a downturn. If your “satellites” focus on sectors that are less connected to the stock market, e.g. commodities, your overall portfolio volatility may decrease further.

2. Reduced Fees

If the “core” portion of your portfolio is in passively managed funds (like most ETFs), your overall fees will be relatively low. This is because management fees in ETFs are generally very low. Only the actively managed “satellite” will be incurring more of these fees and any extra commission or possible sales charges or commissions with a higher turnover rate.

3. Time-Saving

While your passive “core” will not require much time, you should still periodically review it (like anything else in your investment portfolio)! This is, of course, still better than managing your entire portfolio actively, so having this “core” gives you a lot more breathing space to settle other life goals.

Conclusion

The core-satellite strategy is an effective risk management strategy implemented on your portfolio that can help save costs and time. It’s perfect for both beginner and more seasoned investors. If you need help setting one up, consider reaching out to various advisors.

CORE-SATELLITE STRATEGY. COMPLETED. ✅

Sources: