Best Personal Loans to Get in Singapore 2023

Personal loans have become a popular financial tool for many individuals in Singapore. These versatile loans can help you cover various expenses, from medical emergencies and home renovations to education costs and debt consolidation. In this article, we'll explore the best personal loan options available in Singapore, providing you with valuable insights to make informed decisions about your finances.

But first, let's introduce you to MoneyFitt, your trusted hub for personal finance content and information. So, as you read through this blog, remember to check out MoneyFitt for even more in-depth information and guidance on personal loans in Singapore and other financial matters.

Singapore's financial market is known for its diverse personal loan products offered by traditional banks, licensed moneylenders, and online lenders. The variety of choices can be overwhelming, so it's crucial to assess your needs, repayment abilities and understand the loan terms and conditions before you commit. Have a clear debt repayment (or at least reduction) plan to best avoid falling into a vicious debt cycle, and learn how to budget correctly before applying to any personal loan.

Remember, lenders are trying to make a profit from your borrowings. They are providing a service, but don't forget that the interest you pay goes to the bank and its shareholders. Wouldn't it be better if you got paid interest instead?

A Singaporean's Guide: Factors to Consider Before Applying for a Personal Loan

A) Assessing Your Financial Needs

Before taking out a personal loan, it's essential to identify your financial needs. Are you borrowing to cover a large one-time expense, or do you need a financial cushion for everyday needs? Understanding the purpose of your loan will help you determine the loan amount and type most suitable for your situation.

B) Understanding Interest Rates and Repayment Terms

Interest rates are a critical factor in the cost of your loan. In Singapore, personal loan interest rates can be flat or reduced. Flat rates charge interest on the entire principal amount throughout the loan tenure, while reducing rates calculate interest based on the declining balance. It's essential to compare these rates and choose the one that aligns with your financial goals.

Repayment terms, such as loan tenure, can also affect your monthly repayments. Shorter tenures often mean higher monthly payments but lower overall interest costs. On the other hand, longer tenures may reduce the monthly burden but lead to higher interest expenses in the long run.

C) Checking Eligibility Criteria

Different lenders in Singapore have varying eligibility criteria. This may include minimum income requirements, employment stability, and age restrictions. Before applying for a loan, ensure you meet the lender's eligibility requirements to increase your chances of approval.

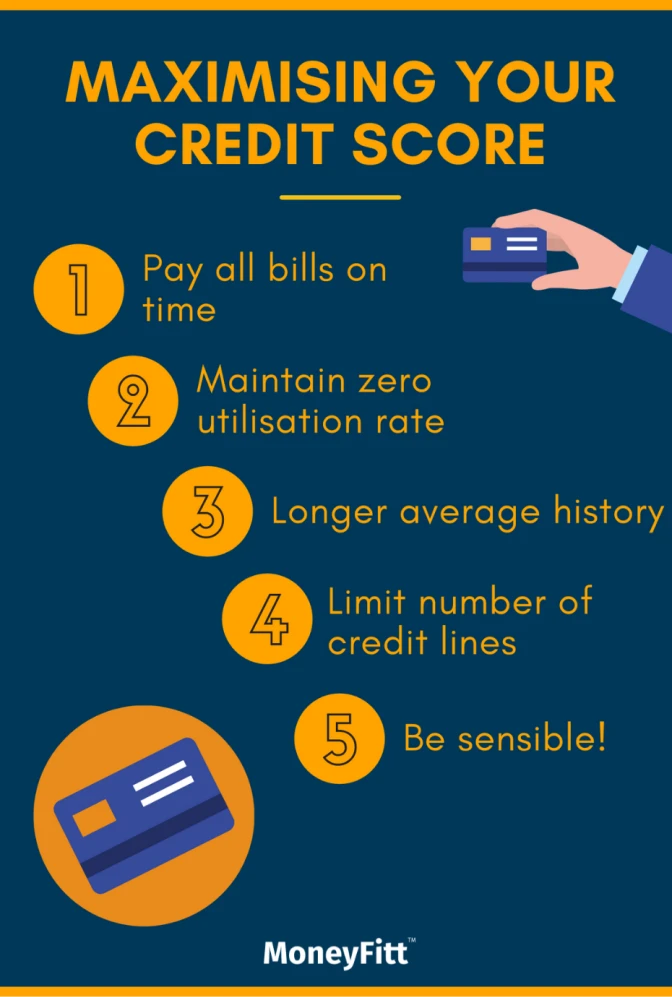

D) Reviewing Your Credit Score

Your credit score is a key determinant of your eligibility for personal loans in Singapore. A high credit score indicates good creditworthiness, which can lead to lower interest rates and more favourable loan terms. Conversely, a low credit score may limit your loan options and result in higher costs. It's a good practice to review your credit report and take steps to improve your score if necessary.

Note: Needless to Say, Please Avoid All Unlicensed Lenders

Also: If you have problems with loans, please seek help. Credit Counselling Singapore (CCS) is an independent, non-profit, Social Service Agency and is the only such organisation recognised by The Association of Banks in Singapore (ABS) https://ccs.org.sg.

Best Personal Loan Options in Singapore

DBS offers a range of personal loans tailored to different needs. Their loan terms are flexible, and interest rates are competitive. You can choose from various loan tenures to match your repayment capacity.

OCBC provides the OCBC Flexi Loan, which offers a flexible repayment schedule and competitive interest rates. Borrowers have the option to redraw their repaid principal, providing added financial flexibility.

Credit 21 is a licensed moneylender in Singapore that offers personal loans with straightforward application processes. They provide loans even to those with lower credit scores and offer competitive interest rates.

Raffles Credit is another licensed moneylender known for its quick loan approval process. They provide personal loans to Singaporeans and foreigners, often with less stringent eligibility requirements compared to banks.

Lendela is an online platform that connects borrowers with multiple lenders, allowing you to compare loan offers and find the best rates and terms. They offer a hassle-free online application process.

SingSaver offers a convenient platform to compare and apply for personal loans from various lenders in Singapore. It provides instant cash loans with competitive interest rates and flexible repayment options.

Comparison of Personal Loan Options

A) Interest Rates, Fees, and Charges

When comparing personal loans, it's essential to consider not only the interest rates but also any additional fees and charges. Banks typically have lower interest rates, but they may charge processing fees, while licensed moneylenders and online lenders might have slightly higher interest rates but fewer fees.

B) Loan Amounts and Tenures

The loan amount you can borrow and the loan tenure can vary significantly among different lenders. Banks often provide higher loan amounts with longer tenures, while licensed moneylenders and online lenders may offer smaller loan amounts and shorter tenures. Choose a lender that can accommodate your specific financial needs.

C) Eligibility Requirements

Eligibility requirements can vary widely. Banks typically require a higher income and more stringent criteria. At the same time, licensed moneylenders and online lenders might be more flexible, making it easier for individuals with different financial profiles to secure a loan.

D) Application Process and Approval Time

Banks may have a more extended application and approval process, while licensed moneylenders and online lenders usually offer faster approvals. If you need funds quickly, this can be a crucial factor to consider.

Tips for a Successful Loan Application

A) Preparing Required Documents

Gather all necessary documents before applying for a personal loan. Typically, you'll need proof of income, identification, and address verification. Having these documents ready will streamline the application process.

B) Making Sure Your Credit Profile Is in Good Shape

If you have time, work on improving your credit score before applying for a loan. This can help you qualify for better loan terms and lower interest rates.

C) Comparing and Selecting the Best-Suited Loan Option

Consider your financial needs, creditworthiness, and repayment capacity when choosing a personal loan in Singapore. Don't rush into a decision. Take the time to compare loan offers from different lenders and select the one that best aligns with your goals and budget.

Conclusion

Choosing the best and right personal loan in Singapore is a decision that can significantly impact your financial health. By carefully assessing your needs, understanding the loan terms, and considering factors such as interest rates, fees, and eligibility requirements, you can make an informed choice. Whether you opt for a bank loan, a licensed moneylender loan, or an online lender, the key is to find a loan that suits your unique financial situation.

And remember, Moneyfitt is your go-to resource for the best knowledge on top personal loans, credit scores, and other financial topics. So, as you embark on your journey to secure your financial future, be sure to explore MoneyFitt's wealth of resources and make your financial decisions with confidence!