5 Tips to Help You Find the Right Insurance Agent

Helping you find someone reliable and trustworthy to service you and your family if and when you need it the most!

- Taking the time to carefully consider your ideal insurance policy is essential. So is taking the time to carefully consider the right agent to service you.

- Having a good agent (i.e. financial advisor/consultant) will make a world of difference in terms of your experience in the event of claiming from or making amendments to your insurance policies.

- Since the insurance industry has been around for a long time, there are several common traits shared by truly proficient agents, which can be easy to spot if one knows what you are looking for.

In your search for information about the right insurance policies, one topic seems always to be implied but never outright talked about; picking the right insurance agent (or financial advisor/consultant) is arguably the more important aspect.

The right agent will help find you the policy that suits your needs now and into the future, and that is right for your budget, not one that is simply maximising the commission they receive from the transaction!

Your agent needs to be knowledgeable, approachable and capable enough to represent you should a crisis arise, and it comes time to make a claim on your policy.

The Problem

Everyone's heard horror stories of insurance agents who push products on prospective clients regardless of their needs or wants, which may be completely unsuitable. All in the hopes of making big commissions, hitting their revenue targets and never speaking to the prospect again. As a result, much like a young person who just suffered a recent heartbreak, many clients become hesitant to put their trust in any other agents they subsequently meet.

How to Solve the Problem

There is a common saying in the insurance industry: “if a prospect/client doesn't ask an agent questions that make them squirm or feel uncomfortable, they're asking the wrong questions”.

There is absolutely nothing wrong with asking a new (or even your current) agent challenging questions. It is your money, after all! It may surprise you that agents filter their leads and prospects to determine their quality, and so it makes perfect sense that you should do the same to someone looking to sell you something.

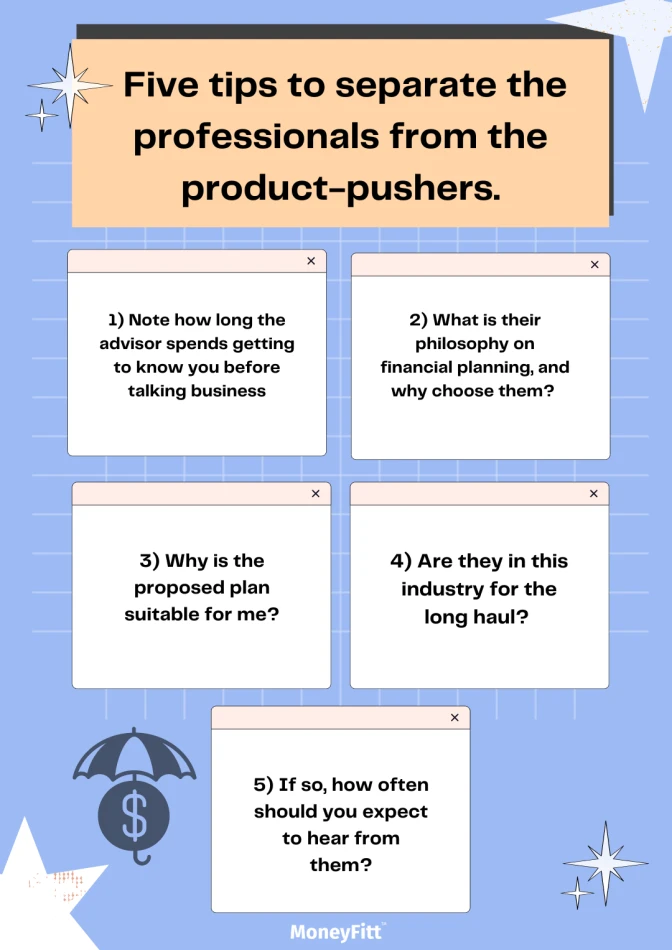

Not sure where to start? Here are five key inside tips you could quietly use to vet the agents you meet to separate the sincere from the hard sells and the professionals from the product-pushers.

1) Note How Long the Advisor Spends Getting to Know You Before Talking Business

This is not so much a question as it is a silent check. Still, it is critical to tell whether an agent is looking to make a quick buck selling a product or selling a real solution to your needs.

If a financial advisor does not spend at least twenty minutes to half an hour upon first making your acquaintance, asking you about:

- Your career & work life,

- Your family life & hobbies,

- Your existing insurance and how that ties into what issues they feel you face in your current portfolio

... then this is an outright red flag. The above steps are referred to in the industry as performing a "fact-find", which is key to providing reliable, accurate solutions.

Think of an insurance agent as a financial doctor and meeting one as the financial equivalent of going to the clinic. If insurance policies are the financial medicine, a thorough fact-find is how to make an accurate financial diagnosis.

TL;DR: If an agent takes their time asking you lots of questions about your professional & personal life before discussing anything insurance-related, don't get impatient. This is their way of performing a sincere fact-find to provide a proper solution and is a good sign that they are trustworthy and professional.

2) What Is Their Philosophy on Financial Planning, and Why Choose Them?

This question is often thought of as a cliché, and so often, as consumers, we do not think to ask an agent this question. Yet, it is essential to ask nonetheless.

And if you're looking for the correct answer, that's precisely the point: there isn't one.

Some will say it's to provide personalised solutions on a professional level. Some will say it's to help their clients live with peace of mind. Regardless of their answer, there are only two things to look out for:

- Logic: If their answer makes sound sense and is honourable/ethical

- Sincerity: In answering this question, it is usually apparent which agents have memorised a scripted, clichéd answer as opposed to an honest one, from-the-heart

And if your agent does not have a solution for you, or seems to be making up the answer on the spot, don't be alarmed. It may mean they are new or relatively inexperienced and could show that they are sincere and trying their best. Of course, if they can answer this question immediately, without flinching or stuttering, it means they are either an experienced professional or faking it!

TL;DR: There is no model answer. But if the answer your agent gives to this question is sincere and ethically makes sense, they may be worthy of your trust.

3) Why Is the Proposed Plan Suitable for Me?

Assume the agent in question has passed through points 1 and 2 with flying colours, and you are now at the real reason for meeting: business.

A policy has been proposed. No doubt your agent has talked about all of its perks, pros & privileges. But watch if the proposal is being praised on a non-personal level to high heavens.

"So, why do you think this is good for me? Me personally?"

Now, you'd start to see the importance of point 1 (the fact-find). An agent who is a sincere professional will have done so thorough a fact-find that they will give you a stellar answer, one that leaves you satisfied with their reasons for the proposal. If they didn't do such a fact-find, their justification would be nonexistent, flimsy at best.

TL;DR: Through all of this talk of red flags, things to applaud or to avoid, it is important to tie it all back to a straightforward question: "Does it make sense for me to buy this or not?"

4) Are They in This Industry for the Long Haul?

Points 1 through 3 have been mainly in and around the pre-sale. Now, we come to a point where we assume that you've met an agent, and by your judgment, they are a sincere professional and have proposed a plan that checks all the right boxes.

Now we look at the post-sale dynamic, the aftercare.

As previously noted, many of us may have experienced the irritation of having an agent who essentially disappears after a sale is made. A common reason for this is that junior agents are bonded to contracts two years at a time, and when those two years are up, they may choose to transfer to a different company or to leave the industry entirely.

Regardless of their reasons, this undoubtedly leaves you as a policyholder in a difficult position when it comes to being serviced adequately.

Note - any new agent who takes over the servicing of your policy in the previous agent's stead does not receive any commissions for doing so, so they don't have much incentive to help you out.

TL;DR: Simply ask your agent how long they have been in the industry and if they plan on staying on for a career in insurance long-term. Even those who don't will often say they do to sign your business to themselves, but they will appear very insincere in saying so, which should be easy to spot.

5) If So, How Often Should You Expect to Hear From Them?

By now, your agent has your trust that they are a serious career professional who will be around for many years to come.

However, you will be far from their only client if that's true. Their intention to be in the industry long-term is more of a commitment to themselves. It's good, obviously, but does not directly translate to how they intend to serve you personally.

What is important to you is that despite how successful they may become or how deep their client pool gets, they will be contactable and approachable for you as a paying customer.

Be bold. For example, request for them to update you once a year. And if not, simply ask them when & how often they can expect to hear from you. Hold them to it. No agent would be ridiculous enough to promise you once a week or once a fortnight, but whatever they promise, hold them to it. You may not want to see them more than once a year, but a regular review is a good habit to develop and something that a good agent should be happy to do with you.

Much like the insurance policy you bought from them itself, this line of questioning is an exercise in giving yourself peace of mind that you are safe should any issues arise in the future.

Conclusion

There is a reason why people often resort to taking up insurance policies either with friends or agents referred by friends; you are looking for trust, not on a corporate level with the insurance company but on a personal level with the agent servicing you.

Granted, there are those in the industry with unethical practices which give sincere professionals a bad name. Still, with the help of the five actionable points above, you can boost your chances of finding someone reliable and trustworthy to help you and your family if and when you need it the most.

FIVE THINGS TO LOOK FOR IN AN INSURANCE AGENT BEFORE PURCHASING. COMPLETED. ✅

Sources:

1. Header photo from Pexels