4 Reasons to Choose Money Management Apps

In today's dynamic world, mastering the art of financial management is key to achieving stability and prosperity. At the forefront of this revolution stands MoneyFitt, a leading money management app in Singapore, redefining how individuals and businesses approach their finances.

Discover how money management apps like MoneyFitt empower users with seamless interfaces and intelligent insights. Unleash the potential of expert tips and the best money management content in Singapore, elevating your financial understanding and optimising your planning.

Delve into the remarkable versatility of MoneyFitt, offering tailored solutions for personal goals and business objectives. With utmost security measures, your financial data is protected, fostering trust and confidence.

Welcome to our blog, where we invite you to explore the unparalleled benefits of money management apps. Dive in and discover a pathway to financial freedom and success, making your financial dreams tangible. Let's venture together, exploring the vast landscape of money management apps and shaping a brighter financial future. Read on to embark on this empowering financial expedition!

4 Compelling Reasons to Choose Money Management App in Singapore

1. User Friendly Interface

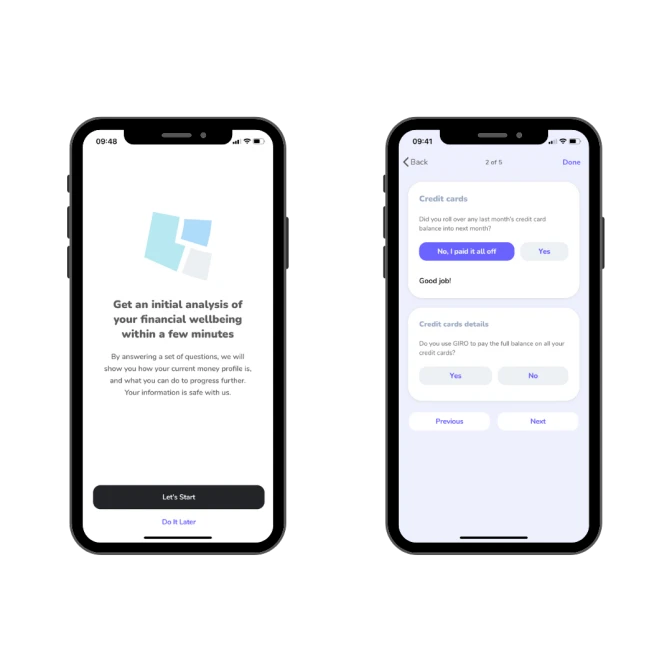

In the rapidly evolving realm of money management apps, a user-friendly interface emerges as a critical factor for achieving success. Financial management is becoming increasingly complex, so individuals are searching for platforms that simplify processes and offer ease of use. MoneyFitt, a prominent money management app, takes this need to heart and redefines user-friendliness for a seamless financial experience.

With its intuitive design and easy-to-navigate layout, MoneyFitt stands out as a champion in user-friendliness. Even for those with limited financial expertise, the platform offers swift access to its features minimising the learning curve and maximising efficiency. Its aesthetically pleasing design and logical arrangement of features ensure a seamless experience, allowing users to focus on their financial goals rather than grappling with the app's functionality. Users can devote more time to strategising and planning their financial future by reducing the learning curve and simplifying financial tasks. Clear visualisations of guided steps provide quick insights, aiding in better decision-making.

Moreover, the app's responsiveness and user-oriented design foster a sense of confidence and ease, instilling trust in users to manage their finances effectively. With MoneyFitt's user-friendly interface, financial management becomes an empowering and gratifying journey, elevating the experience of achieving financial stability and success.

2. Unique Selling Proposition (USP)

The Unique Selling Proposition (USP) of a money management app is crucial in determining its value to users. When it comes to managing finances, the significance of a user-friendly interface and personalised financial guidance cannot be overstated. This is precisely where MoneyFitt, Singapore's leading money management app, stands out from the crowd.

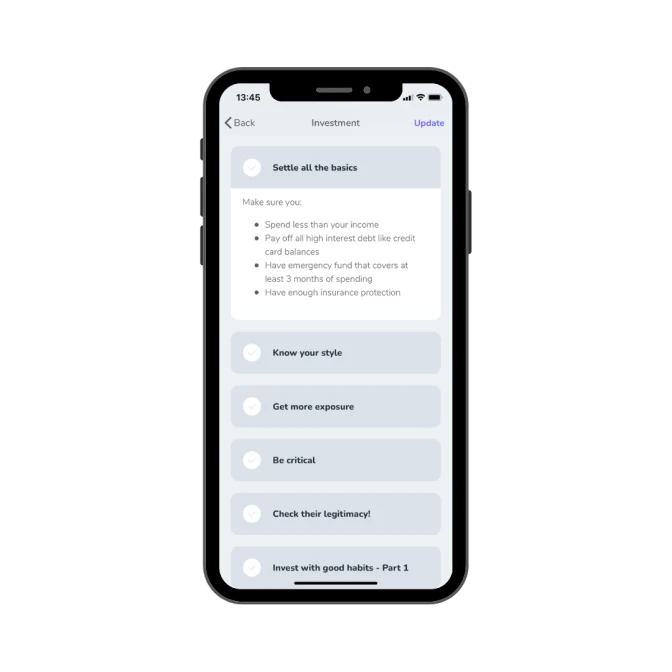

MoneyFitt's first USP lies in its advanced algorithms that cater to the unique financial needs of each individual. By comprehensively analysing users' financial situations and objectives, MoneyFitt offers actionable steps to improve key areas of financial well-being, including Spending, Credit Card Management, Emergency Fund creation, Protection Planning, and Investments. This personalised guidance enables users to make informed decisions, empowering them to improve their overall financial health with confidence and clarity.

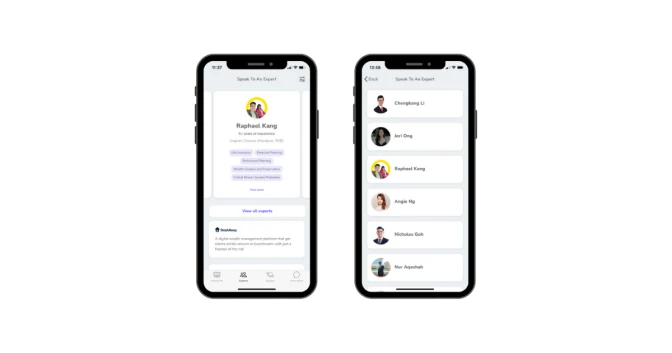

Furthermore, MoneyFitt takes its commitment to user satisfaction further with its other USP - access to a network of Singapore's trusted financial experts. Users can gain access to a matching service that connects them with suitable financial advisors. This network of reputable experts ensures that users can seek specialist advice tailored to their unique financial goals. With no commitment or hard sell, MoneyFitt allows users to choose expert advisors that fit their specific requirements and preferences. Whether budgeting, investments, or protection planning, MoneyFitt equips users with the tools and knowledge to address their financial needs effectively.

3. Key Features

When choosing a money management app, its key features are pivotal in determining its user suitability. MoneyFitt, a preferred choice for Singaporeans, stands out with its exceptional features that cater to diverse financial needs.

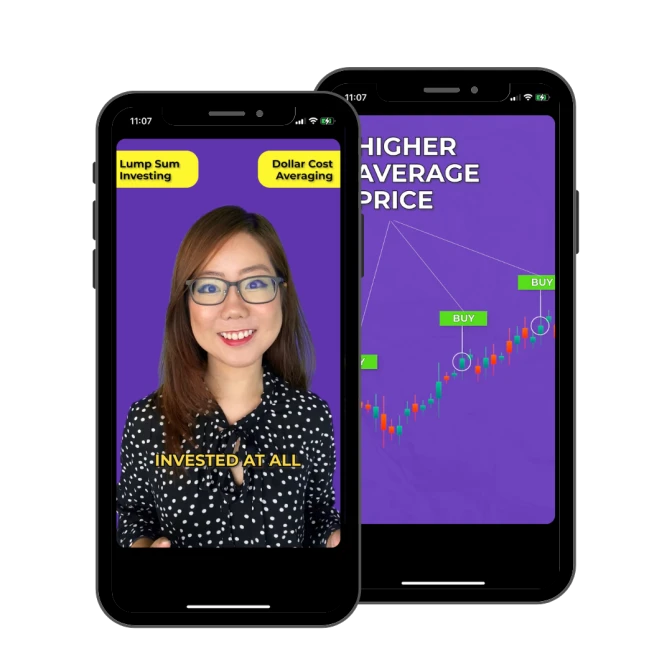

The "Explore" tab within MoneyFitt provides access to a vast library of financial literacy content, including articles, videos, quizzes, infographics, and interactive tools. Users can tailor their exploration by selecting specific interests, ensuring they receive relevant and engaging content. With contributions from MoneyFitt and reputable third-party sources like Redbrick Mortgages, Syfe, and Heritance, users benefit from unbiased consumer content, free from any sales agenda.

MoneyFitt's "Sliders" feature is another standout aspect, offering personalised and actionable steps for five key areas of personal finance. Users receive clear guidance on what to do, which steps to prioritise, and the reasons behind these recommendations, empowering them to confidently address financial challenges.

The "Expert" feature demonstrates MoneyFitt's commitment to assisting users in their financial journey. With a simple touch, users can connect with financial experts who understand their specific needs and aspirations. This no-commitment, no-pressure approach ensures users can seek advice tailored to their requirements, even though MoneyFitt does not provide direct investment or insurance advice.

Through these exceptional features, MoneyFitt cements its position as a reliable and empowering money management app for Singaporeans. By providing unbiased financial content, personalised guidance, and access to trusted experts, MoneyFitt equips users with the tools and knowledge to achieve their financial goals confidently and clearly.

4. Security and Privacy

Security and privacy are top priorities, and one of the great benefits of money management apps, MoneyFitt, ensures users' data remains safe and confidential. The app employs industry-standard encryption protocols to protect sensitive data, making it inaccessible to unauthorised parties. Data protection measures are also in place to prevent unauthorised access and misuse of user information, bolstering the app's overall security.

MoneyFitt is committed to maintaining user privacy, adhering to strict privacy policies and data protection regulations. User data is never sold or shared with third-party entities, ensuring it is solely used to enhance their financial experience within the app.

By prioritising security and privacy, MoneyFitt provides users with a secure environment to manage their finances, empowering them to achieve their financial goals with confidence and peace of mind.

Conclusion

Money management apps offer numerous benefits, and MoneyFitt stands out as the ultimate solution that covers all your financial needs. With its personalised guidance, expert support, user-friendly interface, and robust security measures, MoneyFitt provides a seamless and secure financial management experience.

From optimising spending to planning for retirement and exploring investment opportunities, MoneyFitt empowers you to make informed decisions while protecting sensitive financial data.

As a Singaporean seeking financial stability and success, MoneyFitt is the perfect companion. Download and use the app now to experience the convenience and empowerment it brings to your financial journey.