What Are the Non-taxable Events in Singapore?

The most notable non-taxable event is an extra incentive for you to invest!

- Taxes are a financial charge on the taxpayer by a governmental organisation, used to help fund public goods and services such as healthcare, education, infrastructure and defence.

- The tax authority in Singapore is the Inland Revenue Authority of Singapore (IRAS), which collects taxes and advises the government on tax policies.

- In Singapore, there is no tax owed on capital gains, making investing an attractive way of earning tax-free income.

Notable Non-taxable Events in Singapore

Capital Gains

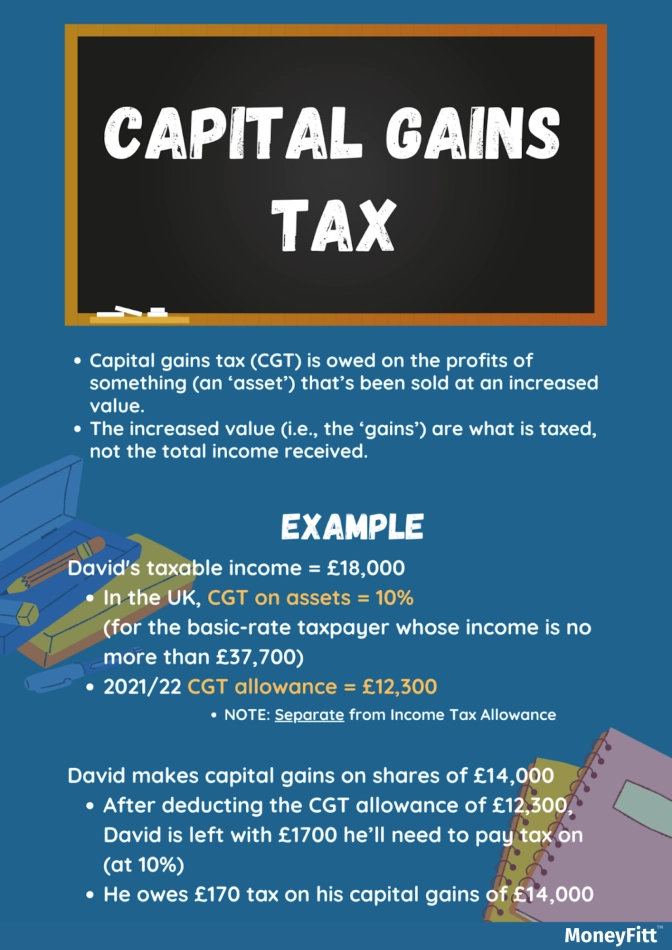

Capital gains tax (CGT) is owed on the profits of something (an ‘asset’) that’s been sold at an increased value. The increased value (i.e. the ‘gains’) is taxed, not the total income received.

In Singapore, any gains made from shares and other financial assets are generally non-taxable. Likewise, insurance policy payouts are non-taxable. The non-existence of capital gains tax in Singapore contributes to its tax haven status.

Gains from the sale of a property are not taxable unless the seller has bought and sold the property with a profit-seeking motive (i.e. the majority of their income comes from trading properties). Criteria for determining whether somebody is deemed to have profit-seeking motives include:

- Whether they have the financial resources to be the owner of the property in the long run or not

- Frequency of buying and selling properties

- How long they have been the owner of the property

- Why they purchased and sold the property

For further information, contact the IRAS here.

Dividends

Dividends are the distribution of profits you receive as a company’s shareholder, usually paid out in cash or in kind. In Singapore, dividends are not taxable if they are:

- Distributed on or after 01/01/2008 by a Singapore based company under the one-tier corporate tax system (ex. co-operatives)

- Foreign dividends acquired in Singapore (by residents) on or after 01/01/2004. Foreign sourced dividends acquired by a Singapore resident through a partnership in Singapore can also be exempt, if certain conditions are met.

- Revenue given out by REITs (ex. distributions given to individuals through partnerships in Singapore, or from continuing a business, profession or trade in REITs)

You can tell which forms of dividends are subject to tax by the exclusions given above!

What Does This Mean?

The luxury of not paying tax on capital gains or dividends makes investing an attractive way of earning tax-free income in Singapore, which you could choose to reinvest for potentially supercharged compounding gains. Many of us choose to invest for long-term financial goals, such as retirement, which require a very large sum of money. Therefore, not having to pay typical capital gains tax rates could mean your profits are substantially higher (as long as you’re a successful investor!).

Other Non-Taxable Events in Singapore:

Capital acquisitions – inheritances/gifts above a certain limit.

Inheritance – the estate of an individual who has passed away and left to a Singapore tax-payer. The value is based on the value of their assets, minus liabilities.

Wealth – an individual’s net worth, which is their assets minus liabilities. Singapore relies purely on taxing income instead of wealth tax.

NON-TAXABLE EVENTS. COMPLETED. ✅

Sources: