What Are Fund Distributors and How Do They Work?

Are they worth your time (and money)?

- Unit trusts are an easy and effective way to diversify your portfolio and constitute money pooled from multiple investors and invested into assets such as stocks, bonds and short-term debt.

- Unit trusts are "actively managed" in that they employ well-paid portfolio managers to pick and choose which assets to buy and sell. They seek to outperform their peers or a benchmark.

- Fund distributors typically make money through sales commissions for selling an investment companies’ funds, plus numerous other fees.

What Are Fund Distributors, and How Do They Work?

Before we can understand the workings of fund distributors, we need to understand the unit trusts (also known as mutual funds) they deal with. Unit trusts are made up of a pool of money collected from many investors to invest in securities (bonds, stocks etc.) and are run by highly-paid professional managers. A unit trust allows retail investors instant portfolio diversification and access to the stock-picking and portfolio construction skills of leading fund managers and their (usually enormous) teams.

There is no shortage of unit trusts out there. To get a better idea of the different types of funds, you could look at companies such as Blackrock and Fidelity. Both offer search tools to sort offered funds based on asset class, markets/regions and even sustainability. The two firms provide this despite being fund managers and running competing funds.

Some retail investors may feel that their portfolio has enough passive investment strategies, such as buying and holding stocks or investing in index funds and exchange traded funds (ETFs). In that case, they may broaden their approach and invest in unit trusts, potentially giving access to assets or markets that may have been tricky to invest in independently.

For example, investing in emerging markets may prove difficult due to many risks:

1. Socio-Political Issues

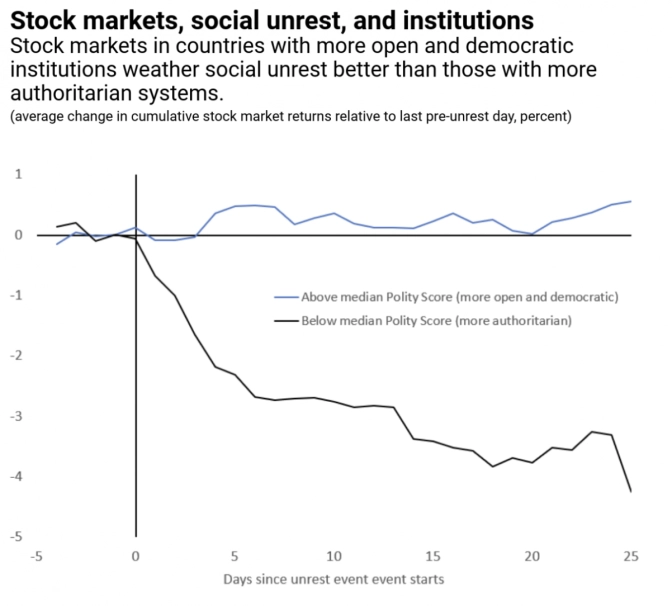

Investing in emerging markets may prove difficult when social unrest such as mass protests or riots occurs. The following chart from an IMF working paper demonstrates increased stock market volatility in countries with more authoritarian political systems.

2. Exchange Rate Fluctuations

For example, you put $2000 in Indian shares at the start of the year, and the prices don't move during the year. However, the Rupee gains 10% against the Dollar (USD), so when converted back to USD at the end of the year, the investment buys 10% more in USD.

3. Administrative Hurdles

Since emerging markets generally have less liquidity than developed markets, brokers may charge higher commissions since more efforts are required to find trade counterparties, and transactions may take longer.

4. A General Lack of Familiarity or Access to Information in the Investor’s Language

Google Translate can only take you so far!

Unit trusts also allow investors to choose from funds that cater to specific needs, from income generation to capital preservation. Investors will register capital gains if the units' prices rise above the amount paid. At the same time, some funds will also pay out dividends.

There are many different fund distributor models, but we will focus on the more common models.

As the name suggests, third party fund distributors sell or distribute unit trusts managed by the fund management companies. Since these companies, not unreasonably, incur costs and aim to profit, fund distributors usually charge additional fees. However, there is usually no affiliation with the fund management companies - note the “third party” portion of their name! As a result, investors will, in theory, not be subjected to hard sells or persuaded to invest in specific funds.

In reality, distributors are often incentivised to promote certain funds, subject to local regulations.

How Do Fund Distributors Make Money?

While fund distributors are typically unaffiliated with fund management companies, they have partnerships.

#1 Distributors typically earn sales commissions for selling an investment company’s funds and may also earn fees related to marketing, networking, due diligence, platform maintenance, and administration.

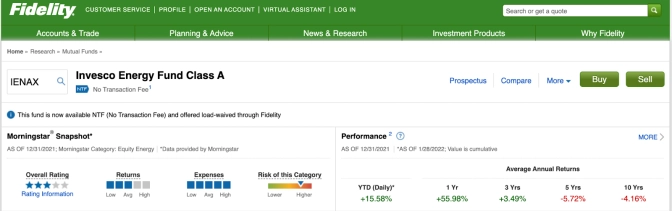

Example - Fidelity would receive sales commissions for selling Invesco Energy Fund Class A (IENAX)

Here, it would also be appropriate to talk about the fees that actively managed funds charge to investors.

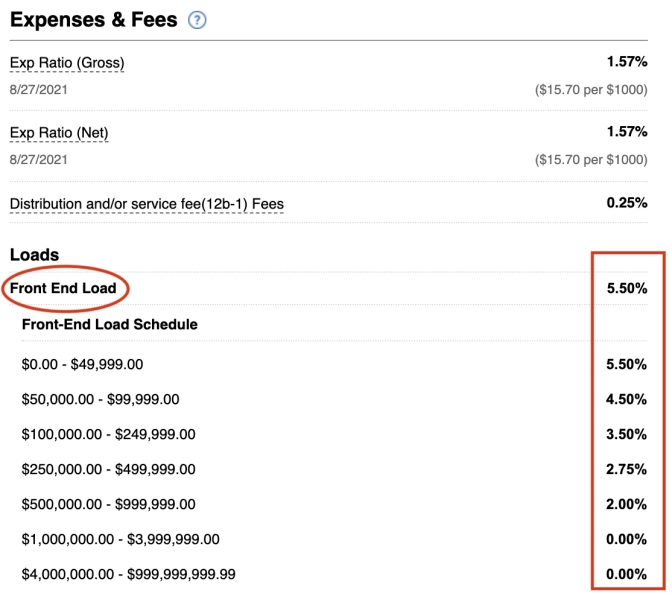

#2 Unit trusts charge a sales commission called “front-end load”, typically a flat fee of around 2-3% (but possibly as much as 4-6%) to the investor upon purchasing the mutual fund. The $100 you invest in the unit trust only buys you between $95 and $98 of assets before starting.

Using the fund discussed previously, the example below shows that the “front-end load” fee is as high as 5.5%!

#3 A “back-end load” is charged when the investor redeems the unit trust, though those have been getting rarer

#4 You may also be charged administrative fees

Saving time and simplifying admin work is valuable in terms of your time and, possibly, blood pressure, so how much you might be willing to pay for these “perks”?

What Are the Costs for Fund Distributors?

Unit trusts also have to pay distributors and advisors to push their products, driving up their marketing fees. Multi-year trailing (or retrocession) fees may also be charged to unit trust managers. Suppose an investor owns an investment for more than a year. In that case, the unit trust manager will continue to pay this fee to the original distributor from the fees they earn from managing funds.

The Good News

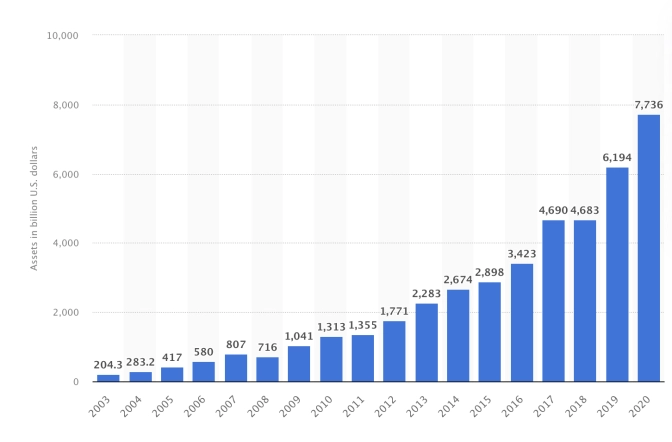

However, more funds are moving away from excessively charging investors due to declining popularity (ETFs, for example, have risen in popularity because of their low fees) and new regulations.

Development of Assets of Global ETFS From 2003 to 2020 (In Billion Us Dollars)

If you’re considering investing in unit trusts, it’s essential to consider the fund management fees and total expense ratios (TERs). While not all trusts and funds charge expensive management fees, they are higher than passively managed index trackers like ETFs. Total expense ratio differentials will add up even without accounting for the fund's potential underperformance of competing ETFs (or relevant benchmark).

What Is the TER?

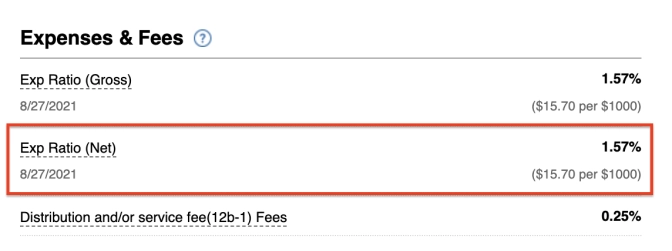

A unit trust's total expense ratio measures the total fund costs (listed above) divided by the total fund assets to arrive at a percentage amount (see below - also known as the net expense ratio).

For example - a fund gives an 8% gain over the year but has a TER of 1.5%, so it would have actually returned 6.5%.

Example

How “Seemingly Small” Fees Can Amount to Substantial Differences in Returns.

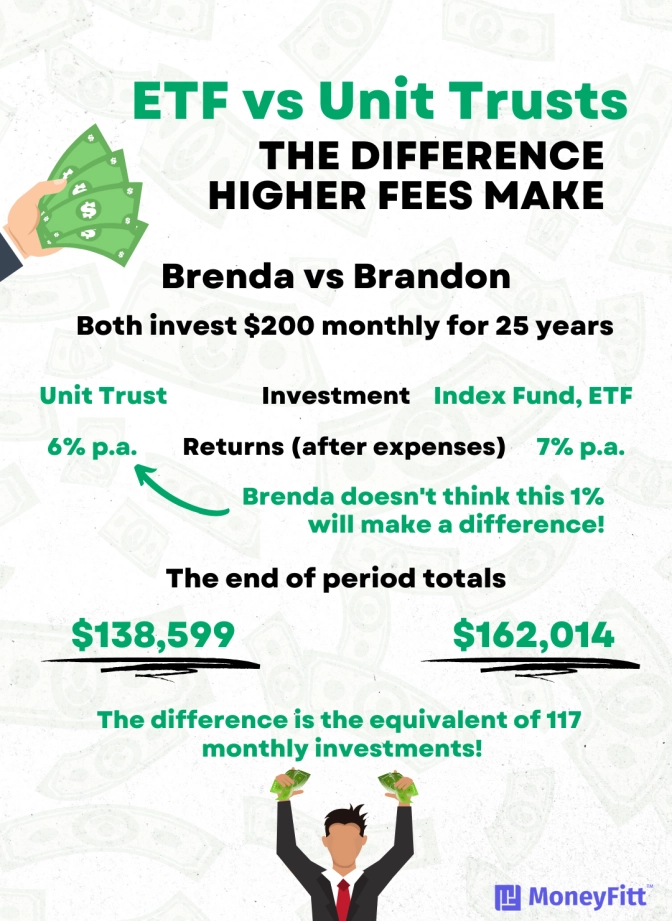

Let’s say Brandon is thinking of investing $200 a month for 25 years in an ETF that returns 7% a year after all expenses. Brandon's sister Brenda prefers to invest in a unit trust with the same market performance but charges a seemingly small 1% higher each year than Brandon's ETF, resulting in an annual return of 6%.

This annual 1% difference would compound to a difference of more than 17% over the 25 years! The ETF (returning 7.0% p.a.) would give Brandon $162,014 at the end of that period, while the unit trust (returning 6.0% p.a.) would give his sister just $138,599. (The difference of $23,415 is the equivalent of 117 months of those $200 investments!)

WHAT ARE FUND DISTRIBUTORS? COMPLETED. ✅

Sources:

- https://www.moneysense.gov.sg/articles/2018/10/understanding-unit-trusts

- https://dollarsandsense.sg/12-investment-platforms-singaporeans-can-use-invest-fixed-monthly-sum/

- https://www.investopedia.com/terms/t/thirdpartydistributor.asp

- https://www.afhwm.co.uk/news/story/what-is-an-investment-platform/

- Header photo from Unsplash