Singapore Car Expenses: You’re in for a Wild Ride

- Being honest is essential when determining the reason you wish to drive. We often want to own a car for social status purposes, as a symbol of wealth, and be fully aware that it may not yet be necessary.

- Remember to factor in the numerous costs, both upfront and ongoing, of car ownership when deciding whether you can afford to have a car or not.

- Use tools such as the LTA calculator to help calculate the overall costs of car ownership.

If you were to search for the price of a Volkswagen Golf 1.4 90KW by country, you would see Singapore perched comfortably on the first-place podium. For S$180,000, you could afford a VW Golf 1.4. Buying the same car in Switzerland, another notoriously expensive country to live in, would cost a third of that. So, what is it that makes driving here so expensive? Is driving classed as an essential expense for people in Singapore? By the end of this article, you ought to have a pretty good idea!

What a car means to an individual varies from person to person. For the taxi driver, it’s a necessity. But for most who can easily go about their day-to-day life using Singapore’s extensive public transport system, cars are more of a want than a need.

Arguably, there is a sizable opportunity cost, defined as the loss of the next best alternative, when purchasing a car. Rather than spending $180,000 on a VW Golf 1.4, the sum could be invested in assets, which are likely to appreciate in value over time, as opposed to a car, which is likely to depreciate in value over time (even if you're lucky enough to catch an upswing in COE prices!)

Why Are Cars So Expensive in Singapore?

Having too many cars on Singapore’s limited road network could cause a lot of disruption. To avoid this, the government has long had measures to limit demand for cars, such as keeping ownership prices high through numerous fees and taxes. We’ll run through all the expenses below.

What Are the Different Costs of Buying a Car?

Use the LTA Car Ownership Calculator here.

Cost of car

The first and most plain-to-see cost of car ownership is its initial cost of buying. The lowest-priced new passenger car, as of September 2023, is the Perodua Bezza 1.3 Premium X (A), priced at $105,999. If you are looking to spend even less, used cars offer a cheaper alternative.

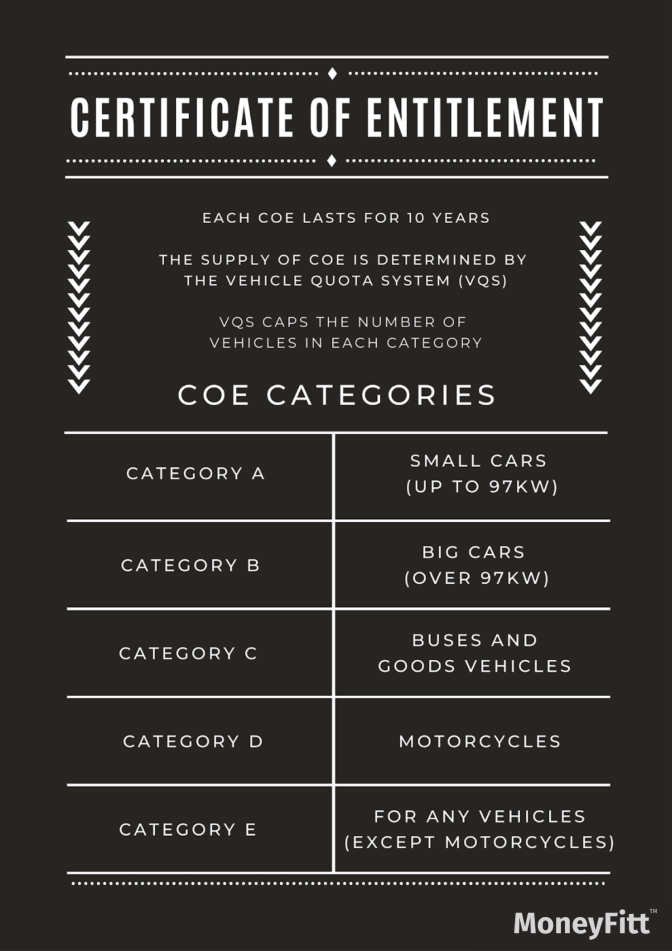

Certificate of Entitlement (COE)

The upfront costs of a car include the price of the car itself (determined by the importer) plus the Certificate of Entitlement. The COE entitles you to register, own and drive a vehicle for 10 years. After the 10 years are up, you’ll have to give it up or pay more to renew it for an extra 5 or 10 years.

The supply of COEs is limited through the Vehicle Quota System, i.e. there is a limit to the number of cars on the road. COEs are designed to allow market demand to determine who gets to have a car, with the result being to push the cost of owning a car up (by a lot).

To get a COE, you must successfully bid for one at an LTA administered auction. Vehicles are allocated into one of five categories, which a car dealer usually does on your behalf. The COE premium is cheapest for smaller cars (up to 97kW) and more expensive for larger cars (above 97kW).

Changes from 2022 onwards:

Category A

COEs obtained from May 2022 (1st bidding exercise) onwards also include fully electric cars with a maximum power output of up to 110kW.

Category B

COEs obtained from May 2022 (1st bidding exercise) onwards also include fully electric cars with a maximum power output above 110kW.

Interest Costs

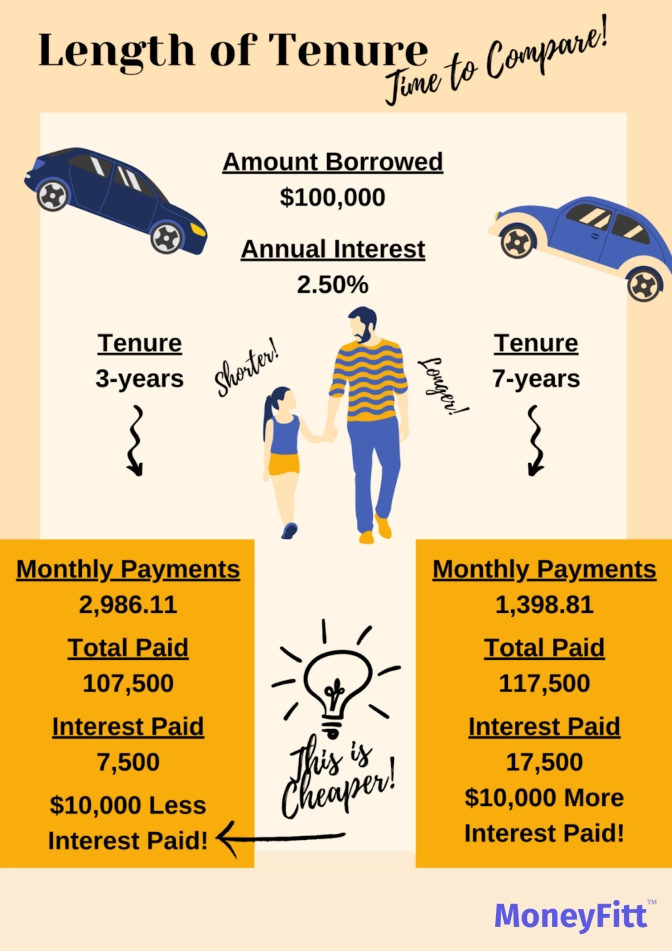

The only way of avoiding interest is to pay the upfront cost of the car in full. Avoid taking on any debt that you cannot afford. Do your due diligence before taking out a car loan, as the methods of computing interest may differ between lenders.

Tip ⭐️

For the same amount of money borrowed, a longer loan tenure means your monthly payment is lower, but your overall interest is MUCH larger!

There are limits to the amount you can borrow based on the Open Market Value (OMW). The OMV is the “original'' price of your vehicle, including the purchase price, insurance, freight and delivery to import the car into Singapore. However, it excludes all taxes and other surcharges like COE, dealer’s profit and registration fees.

- For cars with an Open Market Value (OMV) of less than $20,000, a loan to finance cannot be more than 70% of the purchase price.

- For cars with an OMV greater than $20,000, a loan to finance cannot be more than 60% of the purchase price.

Learn more about motor vehicle loans here.

Registration Fee

The Land Transport Authority imposes a standard Registration Fee of $220 for new cars.

Additional Registration Fee (ARF)

Your ARF is levied on the registration of new cars and is based on a percentage of the vehicle’s OMV. For the first $20,000 of OMV, the ARF rate is 100%, the next $20,000 is 140%, the next $20,000 is 190%, the next $20,000 is 250% and anything above $80,000 is 320%.

Excise Duty

Imposed by Singapore Customs, this tax is 20% of a vehicle's OMV.

Vehicles Emissions Scheme (VES)

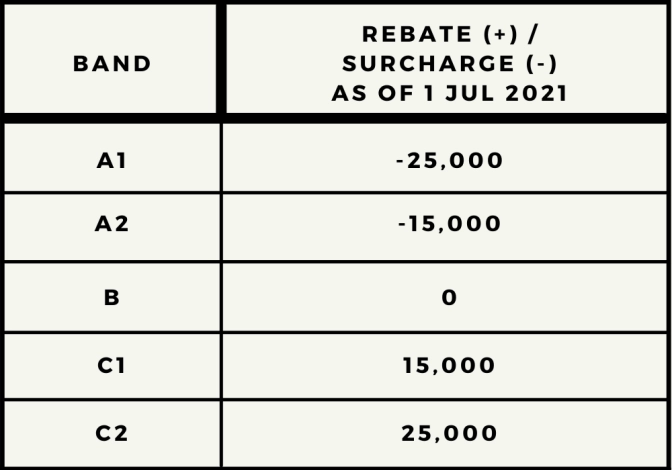

The VES is designed to incentivise Singaporeans to purchase more environmentally friendly cars by offering rebates on low carbon-emitting cars and putting a surcharge on heavy carbon-emitting cars. Vehicles are allocated into specific emission bands (e.g. A1, A2, B, C1 and C2), and each band is subjected to its own rebate or surcharge.

Read more about Singapore’s vehicle emissions scheme here.

Road Tax

Road Tax must be paid every six months or annually for any Singapore-registered vehicle. If you are buying a used car, check to see if any valid road tax is included. The tax takes engine size and vehicle age into account.

You can pay your car tax online here, at AXS stations, via GIRO, or at SingPost and Road Tax Collection centres.

Car Insurance

Car insurance is mandatory. Three main types of car insurance policies are third party, fire and theft, and comprehensive. Several factors determine your premiums, including how much coverage you would like, your age, type of car you own, driving history, and occupation.

These are all factors that the insurer deems relevant to your risk. Insurance premiums are significantly higher for young adults, as the risk of them being in an accident is higher. Do your due diligence and shop around for the best insurance provider.

Costs Incurred on the Road

Additional costs for a car include parking, Electronic Road Pricing (ERP), and petrol. The amount you will be spending on these varies depending on how much you use the car. Seasonal HDB parking lets you park your car in selected HDB car parks at a fixed monthly fee, but you will also need to factor in additional parking fees for other locations.

The ERP system charges drivers for using highly congested roads during peak hours. Drivers are charged whenever they pass an active ERP gantry on the road, and the rates range from $0.50 to $5 per passing. These gantries are mostly found on highways and in central Singapore. The system offers an additional driving deterrent and incentivises public transport during rush hour to reduce congestion.

The amount you spend on petrol will vary depending on how much you drive, plus how economical your car is. Used cars offer discounted upfront prices; however, they are likely to be less fuel-efficient. If you want to calculate how much you would be spending on fuel, use this Fuel Cost Calculator.

Servicing and Repair

The amount you’ll spend on servicing and repair is unpredictable, so it’s important to have an emergency fund set aside to cover yourself.

How you drive, the effort you take to maintain it and how often you drive will all contribute to the condition of your car. Newer cars tend to have very few issues in the first few years, but servicing is required. Generally, older cars are more likely to run into problems.

CAR EXPENSES. COMPLETED. ✅

Sources: