How Cashback Sites Work and Tips for Success

Is everybody involved a winner?

- If you shop online a lot, consider signing up for a cashback site membership so you can earn money while spending it!

- Money from cashback sites may take a while to reach you, so there may be quite a lot of waiting involved!

- Not all cashback sites are able to provide you with the returns they say they will, so make sure you research for the best sites!

What Are Cashback Sites, and How Do They Work?

Cashback sites work by partnering with online retailers such that shoppers do not buy products directly from the retailer’s webpage but rather go through the cashback site to make purchases.

The shopper is incentivised to use such sites to earn cashback in return. The cash you get back as a shopper is typically a percentage of the amount you’ve paid for your product, but it may also vary wildly depending on the total amount spent.

Cashback sites make money from commission earned when referring customers to retailers. Part of this referral revenue is then distributed to you, the shopper. Some retailers pay cashback sites a lot in advertising fees to draw customers to buy more products.

Steps of Using a Cashback Site

(In this section, we use examples from Singapore, but the message is universal!)

1. Try to Research the Top-Rated and Most Reliable Sites

The membership is usually free, but some sites may offer a premium membership that gives you higher cashback rates and bonuses for referring friends and family.

2. Remember to Go via the Cashback Site Instead of the Retailer’s Website

Check that the retailer you wish to purchase from has links to the cashback site, and buy your products from there.

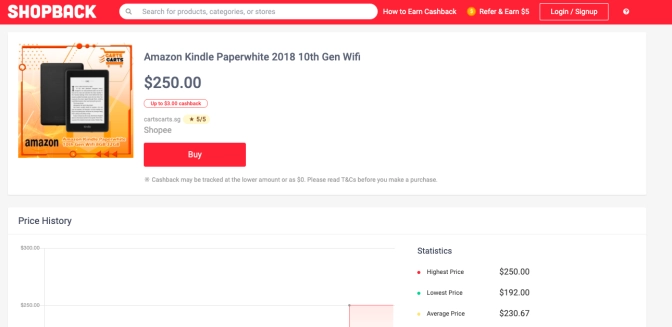

Let’s say you want to buy an Amazon Kindle. Search for it on the cashback site, and when you find a result that you like, you can simply buy it on the cashback site directly:

3. Wait for Your Cashback to Deposit Into Your Account!

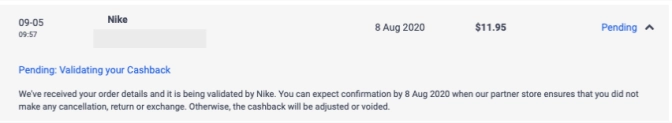

Your transaction has to be approved before your cashback can make its way to you, and if you’ve made a big-ticket purchase or pre-ordered something, you may be waiting on your cashback for quite a while.

Advantages and Disadvantages

The main advantage of using cashback sites is clear: you get to earn some money back when you spend it! The amount of cashback earned could vary greatly depending on how much you’re spending on online purchases, so if you’re only making occasional small purchases.

However, if you shop frequently and are a big spender, using cashback sites could help you to save money while you’re still spending it. You could more accurately think of it simply as a way of getting a discount, as you're not being "given" any money from some kind and generous benefactor!

One must be ultra-careful not to see it as being "free money" or a "windfall gain" because human nature suggests that if you do, you might... well... blow it on something frivolous.

Mental Accounting and Windfall Gains

All money is "fungible" (i.e. indistinguishable and interchangeable) because one dollar is worth the same as another regardless of where it came from or how it gets spent. Obviously!

However, Nobel Laureate Richard Thaler suggested that people don't treat money that way in real life, with money filed into different mental bank accounts ("Mental Accounting") for which different rules apply.

The money you receive tends to be thought of as either “regular income” or a “windfall gain”, with people more likely to spend what they think of as windfall gains (e.g. tax rebates, lottery winnings, cashback schemes, money in the pocket of a winter coat, or even a work bonus) than regular income. People are more likely to spend it on luxury goods than essentials, like investments, bills and paying down debt!

According to UK cashback site Quidco, over a hundred of its two million members have made over £10,000 in a year—an average user makes £262 a year. Other than direct cashback, certain sites may offer extra savings through discounts on items. Using such sites is also straightforward, as shown in the steps above.

Firstly, you shouldn’t jump headfirst into using any old cashback site that crops up. Thoroughly research and read reviews of any cashback site you’re thinking of using. The booming industry of cashback sites has led to many small new entrants, and fierce competition may lead to them taking risks and becoming financially unstable.

The other side of this would be since new cashback sites are hungry for new loyal customers, they may offer very generous cashback. If a cashback site goes bankrupt, you’re unlikely to get any of your money back.

Next, as mentioned above, your cashback may take a while to reach you. There have been reports of customers waiting months for their cashback. If you find yourself waiting too long to receive your cashback, you may want to contact the cashback site.

You may also have to accumulate a certain amount of cashback in your account before withdrawing the money. Or, there may be a waiting period (e.g. a week or a month) that has to lapse before you can make a withdrawal. We advise that you withdraw your cashback from your account as soon as possible instead of leaving it. You could then put the money to better use elsewhere.

The main advantage of cashback sites can also become a disadvantage: when you believe you are saving money while spending it, you’re more likely to spend more. The psychology that works behind the scenes when “saving money while spending” occurs means customer loyalty to a brand builds more quickly!

Neural studies have shown that consumers experience more negative emotions when they consider the cost of making a purchase, as they do not wish to part with the money they have worked hard to earn. Cashback rewards serve to disrupt these negative emotions and provide the consumer with positive emotions instead. Due to these positive emotions, you may become more reckless in your spending decisions, and you may buy more than what you set out to purchase.

Top Tips!

Remember that cashback sites earn their money through commissions paid to them by their retail partners. Make sure you’re logged into the cashback site so they can track what you buy and reward you accordingly.

Related to this is the “cookies history” setting in your browser. You have to clear your cookies if you were shopping directly from the retailer’s website instead of using the cashback site. There is a clear “cookie trail” from your computer to the retailer through the cashback site. If you forget to do this, your cashback might not be processed. Another tip to help you leave a clear “cookie trail” would be first to do your shopping or browsing in incognito mode. Then when you’ve decided what to buy, you can visit the cashback site directly and make your purchase!

Some cashback sites will also exclude taxes and shipping fees from calculating the total amount for the cashback. Some sites will also pay their cashback in foreign currencies, so there may be a slight difference in the final amount you receive due to exchange rates.

Ultimately, it’s the best deal and not the biggest cashback that should be your priority when shopping online. Like the saying “don’t count your chickens before they hatch”, the same should be said for cashback. Your cashback is not guaranteed, so if you make your purchase decisions based on the amount of money you’re getting back, you may lose more than you save.

HOW DO CASHBACK SITES WORK? COMPLETED. ✅

Sources:

- https://www.investopedia.com/terms/c/cash-back.asp#toc-cash-back-sites-and-apps

- https://www.moneysavingexpert.com/shopping/cashback-websites/

- https://www.theguardian.com/money/2011/jan/22/cashback-websites-cash-for-free

- https://www.bbc.com/news/business-18207304

- Header photo from Pexels

- https://www.forbes.com/sites/forbestechcouncil/2020/09/25/why-the-psychology-of-rewards-confirms-cash-back-is-king/?sh=61a48c9457ae