Dealing With Debt: Credit Counselling and Debt Consolidation

Is a debt consolidation plan right for you?

- If you find yourself building up debt that you are increasingly unable to pay off, this may be a sign of overspending, and you need to be more careful!

- If you are struggling to make your payments and are getting whacked with late payment fees every month, you may want to consider talking to a Credit Counseling service.

- You may want to consider taking up a Debt Consolidation Plan, but before you do, educate yourself on the risks that come with it!

Credit Counselling

You may want to consider going for a credit counselling session run by a credit counselling service, a non-profit organisation that will help you work through your issues with repaying your debt. You should be prepared to talk about your sources of income, the assets you own, and if you have any creditors other than banks, for example, family members. The financial counsellor from the organisation would guide you through working up a budget, and you should be willing to take their advice and listen with an open mind.

Debt Consolidation

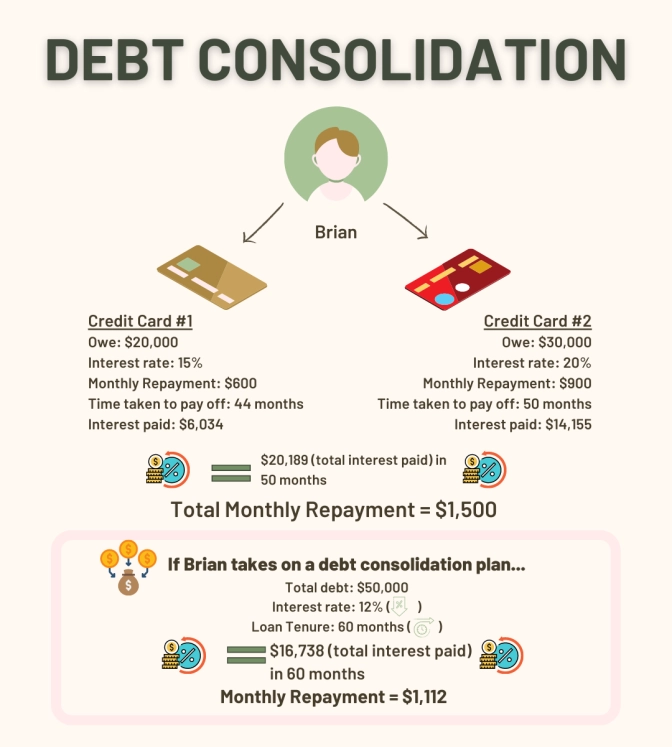

Another avenue for you to tackle repaying your debt is a debt consolidation programme. Debt consolidation means a borrower with multiple debts can apply for a loan to combine and pay off those debts over a particular period. Typically, this loan is offered at a lower interest rate than paying back the original debts. However, this raises the question of why would your creditor allow you to pay off your debt at a lower interest rate? A lower interest rate means the likelihood of full debt repayment increases. Note that debt consolidation does not erase the original amount of debt. Instead, it just makes the repayment process slightly simpler.

One of the more popular forms of consolidating debt is transferring high-interest debt to a balance transfer credit card. A balance transfer could save you money based on the lower interest rate. However, make sure that you still make your monthly minimum payments on time, or you will risk losing the low interest rate (and having late fee charges added to your debt!)

With a debt consolidation plan, you may get to choose your loan tenure, or in other words, how long it would take for you to pay off your loan. You could decide to lengthen your loan tenure to make monthly repayment amounts smaller. However, this means you will pay higher total interest over time. Suppose you want to reduce the amount of interest you pay on loans. In that case, you could set a shorter loan tenure - but ensure that you can manage the higher monthly repayment amounts.

Example:

Brian pays less in total interest, largely thanks to the lower interest rate. Still, the key is now that Brian can pay the monthly repayments of the new loan, which is lower as it is spaced out over a longer period.

In this instance, the banks would get less interest in total. Still, now Brian can actually afford the monthly repayments. If he sticks to it and exercises financial discipline, he will not default on the loan! This means the lending bank actually does get its money back, in the end, thanks to the longer period of the loan. If you do take up a debt consolidation plan, it’s suitable for the bank too.

If you’re unsure about your amortisation schedules, use a loan calculator and check if debt consolidation is the best plan for you.

Also, check with your bank on the types of fees associated with your debt consolidation plan. There could be fees related to:

- Processing of your loan

- Amending your loan application

- Cancelling your loan or drawing down your loan amount

- Defaulting

- Making late payments

One prominent risk of taking up a debt consolidation plan is that it may cause a temporary dip in your credit score. This is because your application for a new loan to combine all of your previous debt would trigger an inquiry on your credit report. Still, if you keep making your monthly repayments on time and avoid taking on new debt, your credit score could see a boost after a short-lived fall.

Make sure to educate yourself on the other pitfalls of a debt consolidation plan as well. When you are speaking with your bank about your debt, you may want to ask them about the finer details of a plan you wish to take up and how you may avoid running into the dangers that such a plan may present.

One major risk of taking up a debt consolidation plan is that it may cause a temporary dip in your credit score. This is because your application for a new loan to combine all of your previous debt would trigger an inquiry on your credit report. Still, if you keep making your monthly repayments on time and avoid taking on new debt, your credit score could see a boost after a short-lived fall.

TOO MUCH DEBT: COUNSELLING AND CONSOLIDATION. COMPLETED. ✅

Sources:

- https://www.investopedia.com/terms/d/debtconsolidation.asp

- https://www.fool.com/the-ascent/credit-cards/articles/4-dangers-of-debt-consolidation/

- https://www.dbs.com.sg/personal/loans/personal-loans/dbs-debt-consolidation-plan?pid=sg-dbs-pweb-article-what-to-do-when-in-heavy-debt-txtlink-dbs-debt-consolidation-plan

- https://www.hsbc.com.sg/loans/things-you-did-not-know-about-debt-consolidation/

- Header photo from Pexels